Charles Bond

Partner

Head of Capital Markets

Leader of Natural Resources Sector (UK)

Report

32

Contents:

After years of moving at a glacial pace, the global energy transition has now kicked into high gear.

In a series of climate change conferences following the landmark Paris Agreement made in December 2015, countries have gradually escalated their efforts to meet the commitments set out in the accord, whose 200 signatories promised to keep global warming below 2 degrees Celsius this century, and ideally below 1.5 degrees, to avoid the worst effects of climate change. Russia's invasion of Ukraine in 2022 caught Europe and the world unprepared leaving many western nations with a large hole in their energy supplies. This shock created an immediate and desperate need to lessen our dependency on fossil fuels.

Now, rather than searching for replacement sources of fossil fuels to replace Russian imports, European countries are accelerating their adoption of greener fuels and transforming international energy markets, according to the International Energy Agency (IEA), which forecasts global clean energy investment will exceed $2 trillion per year by 2030 as a result.1

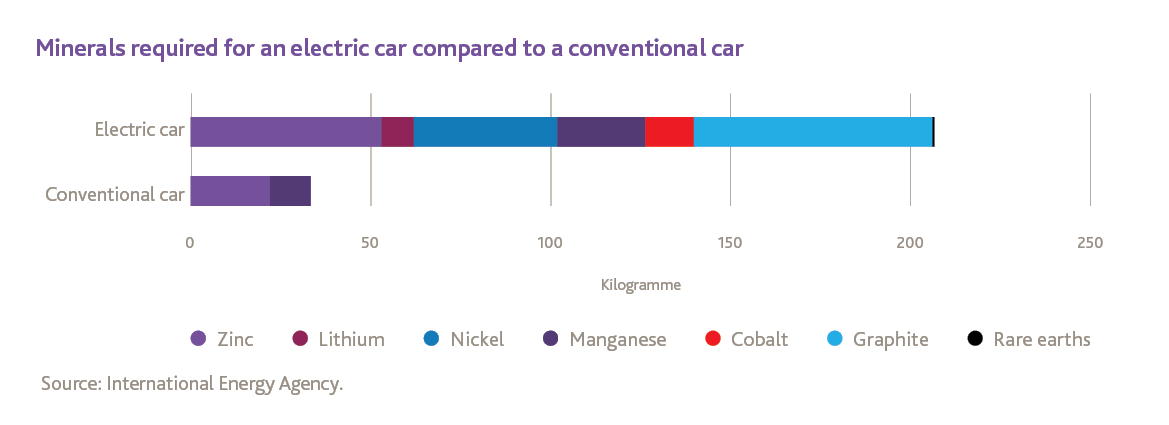

Even before Russia's invasion, commitments to achieve a goal of net-zero emissions were being made by an ever increasing number of governments and major corporations. In contrast, the stream of critical mineral projects coming online, which are key to enabling the energy transition, is (and has been) nowhere near sufficient to meet the demand generated by these commitments. Minerals like lithium, nickel, cobalt, graphite and copper – key to battery technology powering electric vehicles, wind turbines, solar panels and more – emerge from the ground in a few select regions of the world and take significant time to explore for, develop and extract.

In fact, according to the IEA, meeting the resulting carbon-neutrality targets by 2050 will require six times more mineral inputs for clean energy technologies than we require today.

For western nations, the energy crisis that followed the onset of war in Ukraine shone a spotlight on the weaknesses in their energy strategies and related supply chains, and now nations like Canada are well placed to become part of the solution.

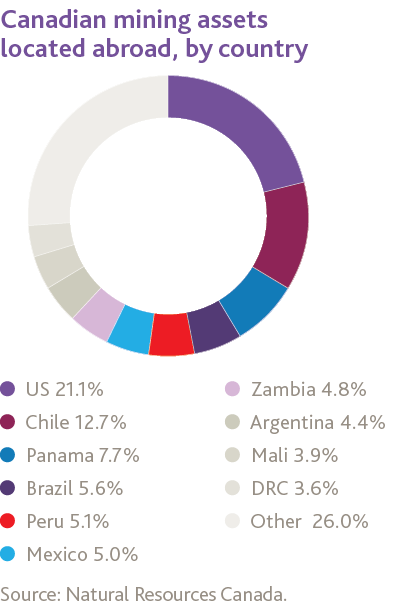

Canada's many advantages enable it to play an important role in the global advanced technologies value chain. In addition to having reserves of most critical minerals, Canada has a sophisticated skilled labour force, low-cost access to inputs such as water and land, a stable and predictable geopolitical situation, a free trade agreement with the United States and the European Union and a strong environmental framework. Infrastructure developments support the mining of critical minerals throughout Canada, including power supply and transportation from remote regions and global shipping lines.

Canada is a major producer of primary aluminum, cobalt, diamonds, molybdenum, nickel, platinum group metals, salt, titanium concentrate, tungsten, uranium, and zinc. In addition, mineral exploration has diversified in recent years, leading to increased interest in commodities such as lithium, rare earth elements, graphite, and chromite, adding to Canada's already considerable list of promising prospective targets.

Few critical minerals highlight Canada's production opportunity better than lithium. Since limited production between 2014 and 2019, the country has not seen any more commercial production - in part due to the sharp decline in global lithium prices in 2019 and 2020.

With prices surging again and several projects nearing production milestones, however, Canada is strongly positioned to capitalize on growing global demand. The country has proven reserves of 530,000 tonnes – enough to place it sixth in the global rankings and accounting for 2.5 per cent of world's known reserves of the metal in 2020. Natural Resources Canada estimates that the country's actual lithium resources could be as high as 2.9 million tonnes in total but there remains much work to be done to prove this up.

Lithium has taken centre stage among critical minerals because of its use in lithium-ion battery technology, being the current technology of choice for electric vehicle batteries. Lithium-ion battery technology is also being explored (along with vanadium and other minerals) as a source of grid-scale energy storage, helping to drive a doubling in global demand for the metal since 2017, alongside a massive spike in its price per tonne that has earned lithium its "white gold" nickname.

But that's nothing compared with future projections: according to the IEA, if we are to remain on target to hit the goals set at Paris, demand for lithium will multiply 40-fold by 2040, the fastest projected growth among critical minerals. Graphite, cobalt and nickel follow at a rate of 20 to 25 times their current demand.

Walking the talk on ESG

The pivotal role of critical minerals, and lithium in particular, in the worldwide shift to net zero has given a major boost to the image of the mining industry as a potential partner to meet net- zero emission targets.

But decarbonization plans remain a double-edged sword for companies in a traditionally greenhouse-gas-intensive sector. Mining materials in a sustainable fashion is essential for those who want to maintain their social licence to operate while enhancing their attractiveness to investors.

Canada is a recognized global leader in responsible mining. The Canadian mining industry practices the highest environmental standards with a deep commitment to sustainable development and production, improving energy efficiencies and reducing greenhouse gas emissions.

Given the low carbon intensity of Canada's electricity grid, refining and further processing in Canada are also very attractive from both a GHG perspective and, depending on the location, from a cost perspective as well. In addition, wind and solar photovoltaic (PV) energy are among the fastest-growing sources of generation in Canada.

Mining innovation

Miners are also doing their bit for the decarbonization effort, using alternative fuels, automating processes and relying on digital technology and artificial intelligence where possible. For example, in northern Quebec, Glencore's Raglan Mine is replacing diesel fuel with wind power. The wind turbine and energy storage facility – the first of its kind in Canada – has helped reduce the mine's greenhouse gas emissions and has the potential to transform the Arctic's energy landscape.

Glencore's new Onaping deep nickel mine in Ontario has also been hailed for its innovative ventilation technology, energy-efficient cooling systems and remote operating centre, which will rely on advanced sensors to allow for real-time management, monitoring and control from the surface. By the time the mine comes online in 2025, its entire fleet of equipment is also expected to run on electricity.

Looking to the future, many in the mining industry are also pinning their hopes on small modular reactors to improve both energy efficiency and project feasibility in remote areas of countries without the networked electricity and transportation infrastructure normally needed to support significant industrial activity.

Off-grid mines are generally supported by diesel generators, but a recent study by Ontario Power Generation suggested that a subcategory of very small modular reactors – those that produce less than 10MW of energy and are potentially as small as a shipping container or train car – used in conjunction with diesel power could replace as much as 90 per cent of the baseload power required for mining operations, drastically reducing the greenhouse-gas output associated with an isolated mining site.

Deal-making innovation

Innovative thinking in the electric vehicle value chain is not confined to extractive and operational technology. Recently, the combination of surging demand for critical minerals and the urgent need for project funding has resulted in some unconventional partnerships, which may portend a paradigm shift for the entire industry.

Recognizing Canada's potential to be a global leader in battery manufacturing, Volkswagen announced on March 13, 2023, that its subsidiary, PowerCo, will build its first overseas "gigafactory" in St. Thomas, Ontario. This massive battery manufacturing facility will represent a significant portion of the North American battery manufacturing sector. It will cement Canada's place in the North American and global battery value chains.

General Motors (GM) is also looking to Canada to be a big part of its EV future. The company has announced it is making a C$2 billion investment in two plants there and the Canadian government is contributing C$259 million to the investment. As part of the investment, GM will develop the first all-electric assembly plant in Canada at CAMI Assembly in Ingersoll, Ontario. GM will start building commercial electric vans there.

On August 17, 2023, the federal government and province of Quebec jointly announced a C$644 million investment into a $1.2 billion project aimed at producing the materials needed for batteries used in Ford EVs. The project which is to be built in Bécancour, Quebec will be constructed by a consortium made up of Ford Motor Company and Korean companies EcoProBM and SK On.

Stellantis N.V. and LG Energy Solution (LGES), announced definitive agreements to establish a large scale, electric vehicle battery manufacturing facility in Ontario. The joint venture company will produce leading edge lithium-ion battery cells and modules to meet a significant portion of Stellantis' vehicle production requirements in North America. The joint venture company will invest over $5 billion CAD ($4.1 billion USD) to establish operations, which includes the all-new battery manufacturing plant located in Windsor, Ontario. Stellantis and LGES expect the plant to serve as a catalyst for a strong battery supply chain in the region that leverages Canada's leadership in the generation of electricity from renewable sources.

General Motors, among others, is also investing in mining to secure its supply chain. The car manufacturer recently became Lithium America's largest shareholder following the closing of a USD$650 million investment. According to Lithium America, proceeds from the investment will be directed toward the development of the company's Thacker Pass project in Nevada, the largest known lithium resource in the U.S. that is fully permitted to begin construction. Ford also recently concluded a deal with Nemaska Lithium whose operations are in Quebec and who will supply Ford with a long term source of lithium hydroxide.

With potentially significant deposits of many of the raw materials needed to fuel the global energy transition, Canada is one of the few nations that it is in a position to create a fully integrated clean energy value chain.

Canada already boasts strong automotive and aerospace manufacturing sectors. Ontario represents one of the two largest automotive manufacturing jurisdictions in North America. It has the distinction of serving as Canadian headquarters for five global original equipment manufacturers: Stellantis, Ford, General Motors, Honda, and Toyota. Together, these companies typically assemble about two million light vehicles each year at their Canadian plants. They are supplied by an ecosystem of nearly 700 parts suppliers across the country.

Canada is also home to many leading aerospace companies such as CAE, Bombardier, Pratt & Whitney Canada, De Havilland Canada, Airbus Canada, Bell Textron Canada Ltd., and MHI RJ who are global leaders in their respective markets. Canada also has world-class aerospace suppliers who are well integrated into global supply chains.

The green transformation of the automotive and aerospace sectors is a priority at the federal and provincial levels and it all depends on access to critical minerals. Working with provincial partners and the private sector, the Government of Canada has made significant investments in attracting cell, battery, and EV manufacturing. The government also made significant investments in sustainable aviation projects, working in partnership with the private sector and the Provinces of Ontario and Quebec. These types of investments in the green technologies of the future will help encourage upstream activities such as new mines or processing facilities.

The case for more investment in Canada received a further boost with the passage of the U.S. Inflation Reduction Act, which includes a provision for a USD$7,500 tax credit for new electric vehicle purchases. In order to qualify for the credit in 2023, 40 per cent of the critical mineral content in the vehicle's battery must have been extracted or processed in the U.S., countries with which the U.S. has a free trade agreement, or have been recycled in North America.

Canada is already in select company among U.S. trade partners with the processing capacity and potential critical mineral deposits to match its mining know-how, and its attractiveness will only increase over time as the legislated threshold for qualification escalates annually by 10 percentage points, topping out at 80 per cent of battery materials in 2027 and beyond.

Domestic and international cooperation

Delivering shorter and smoother approvals for mine development may be more challenging in practice than it appears in writing, considering the realities of environmental review and Indigenous consultation processes, but the federal government has provided a strong framework for the exploration and development of the country's critical mineral resources.

Encouragingly, the critical mineral issue appears to be one of the few topics on which Canada's various levels of government can agree. A number of provincial and territorial governments, including Ontario, Alberta and Quebec, cast aside traditional rivalries to issue their own critical mineral strategies, each complementary to the federal plan.

Outside Canada, the federal government has joined forces with allies to challenge China's current dominance in both the refinement and processing of critical minerals, launching a joint action plan with the U.S. to secure supply chains for clean technology, aerospace and defence. At the recent COP15 in Montreal, Canada also signed on to the Sustainable Critical Minerals Alliance with nations including the U.K., the U.S., France, Germany, Australia and Japan.

For all the overlapping commitments, policies and strategies, the unifying message is that Canada intends to establish itself as a responsible and reliable source for critical minerals.

Control of critical minerals

One side-effect of Canada's global push for critical-mineral independence is its concomitant crackdown on foreign state owned or influenced enterprise (SOE) control of critical mineral projects.

In 2022, the federal government implemented a new policy under the Investment Canada Act (ICA) specifically targeting critical mineral investments by foreign state-owned or influenced entities, emphasizing applications for acquisitions of control of Canadian companies by such institutions will only receive net-benefit approval on an "exceptional basis."

Under the ICA, all acquisitions of control of an existing Canadian business by a foreign investor are subject to either notification or net-benefit review (i.e., an assessment of whether the proposed investment is likely to be of net benefit to Canada), depending on whether or not the investment exceeds the applicable financial threshold for a net-benefit review. The net-benefit review threshold for 2023 for most direct investments by SOEs is $512 million based on the book value of the target's assets. Where net benefit approval is required it must be obtained pre-closing.

In addition, investments by foreign state owned or influenced enterprises relating to critical mineral projects will generally support a finding that the investment could be injurious to Canada's national security – regardless of the size of the investment – under the tighter updated rules. This could result in the possible use of the government's discretionary power to block, condition or even undo closed deals, regardless of whether net benefit approval is required.

Within days of the October 2022 policy announcement, Innovation, Science and Industry Minister Francois-Philippe Champagne, under the new powers, ordering the divestiture of investments by three Chinese companies in Canadian junior miners:

These developments may not necessarily spell the end of state investment in Canadian critical mineral companies, since investments by SOEs from "like-minded" governments may find it easier to clear the national security review hurdle.

Notably, the government's national security review powers apply not only to the establishment of a new Canadian business or the acquisition of control of an existing Canadian business, but also minority investments and the establishment of any entity "carrying on . . . any part of its operations in Canada." As such, the national security review powers can apply to investments in businesses with only tenuous links to Canada.

It is also important to note that, in December 2022, the government introduced significant proposed amendments to the ICA. If passed in their current form, the proposed amendments would, among other things, require pre-closing notification in certain circumstances, including for non-control level investments, depending on whether they relate to prescribed business sectors. While the prescribed business sectors have yet to be specified, critical minerals will likely be one such area.

Under its first Critical Minerals Strategy, launched in December 2022, Canada will invest nearly $4 billion to increase the supply of responsibly sourced critical minerals and support the development of domestic and global value chains for the green and digital economy.

Among the key planks of the federal strategy are a C$1.5-billion Strategic Innovation Fund devoted to advanced projects and various commitments aimed at speeding up the approval and construction of new mines. For example, $40 million is allocated to support permitting in Canada's north, plus another $21.5 million to support the Critical Minerals Centre of Excellence with its new mandate assisting project developers in navigating regulatory processes and federal support measures.

The Trudeau administration also reaffirmed its commitment to a new 30-per-cent critical minerals exploration tax credit, boosting its position as one of the mining world's lowest effective-tax-rate jurisdictions.

The tax credit, previously announced in Canada's 2022 federal budget, will be made available to investors under certain flow-through share agreements, doubling the existing 15 per cent exploration tax credit available for such investors, as long as their projects relate to certain qualifying critical minerals, including copper, nickel, lithium, cobalt, graphite, rare earth elements, vanadium and uranium, among others.

Looking forward, in its Canadian Critical Minerals Strategy and earlier 2022 budget, the federal government recognized the need for even better and more innovative technology to meet the coming worldwide spike in demand for clean energy materials. Allocations of funding for research and development are aimed at every stage of critical mineral exploration and processing, including C$79 million for public geoscience to improve identification and assessment of deposits.

All of this is in addition to existing initiatives, such as the Sudbury, Ont. headquartered Mining Innovation Commercialization Accelerator a provincially and federally supported network designed to connect start-ups and technologists in various industries whose products are ripe for integration in the mining field.

Ontario is home to significant sources of critical minerals, particularly nickel, copper, cobalt and platinum group elements – all of which are essential to the development of EV and battery production. Recognizing the opportunity before it, Ontario has taken important steps in recent years to become a key supplier, producer and manufacturer of critical minerals, as well as a hotspot for EV battery investment.

In 2022, Ontario launched its first-ever provincial Critical Mineral Strategy, a companion to the federal government's strategy. This five-year roadmap aims to support the development of critical mineral mining and EV manufacturing efforts with major investment into the entire supply chain.

The main pillars of Ontario's strategy include enhancing geoscience information and critical minerals exploration, growing domestic processing and establishing local supply chains, and enticing global manufacturers with supply and tax incentives. The strategy also proposes to strengthen connections between the critical mineral producers of Northern Ontario with the growing manufacturing sector in the south.

The province's investments to date include C$35 million for the Ontario Junior Exploration Program (OJEP), including a C$12-million "Critical Minerals Stream," to help junior mining companies finance early exploration projects. Additionally, the province has invested C$5 million in a "Critical Minerals Innovation" fund to support mining, mineral processing, and mineral recovery and recycling projects.

Critical minerals and the Ring of Fire

A key piece of the province's Critical Mineral Strategy involves unlocking the full potential of the Ring of Fire. The mineral-rich region in Northern Ontario was discovered in the early 21st century and spans approximately 5,000 square kilometers. It contains valuable deposits of chromite, nickel, copper and zinc, among other critical minerals.

Ontario sees great opportunity for economic development, job creation and sharing benefits with Indigenous partners in this region. As part of its strategy, the province plans to work in partnership with industry stakeholders and Indigenous communities with a view to maximizing development opportunities for Northern communities – including by ensuring dependable, all-season road access.

Ontario's multi-billion dollar start

As discussed above, following extensive negotiations with both the Ontario and federal governments, Europe's largest automaker, Volkswagen, announced this past spring that it would invest $7 billion to establish its first overseas electric vehicle battery manufacturing plant in St. Thomas, Ontario. The plant is expected to be completed by 2027, and will become the largest manufacturing plant in Canada, supporting the production of batteries for up to one million electric vehicles per year.

Indeed, Ontario's Critical Mineral Strategy already appears to be paying off. In addition to the Volkswagen plant announcement, recent statistics suggest that Ontario's plan is having a positive impact across the entire sector:

In the coming years, Ontario will be looking to build upon this early success as it continues to invest greater and greater amounts in the overlapping critical minerals and EV sectors. The Critical Minerals Strategy along has already positioned the province as national leader in area, accounting for 24 per cent of all mineral exploration expenditures in Canada (more than other province).

As the global energy transition picks up speed, there has never been a more exciting time to be involved in the EV supply chain and the critical mineral sector.

As the global energy transition picks up speed, there has never been a more exciting time to be involved in the EV supply chain and the critical mineral sector.

Canada's Critical Minerals Strategy has put some substance behind the country's claim to become the world's friendliest source and industry is taking note.

With global automakers such as Volkswagen, General Motors and Ford, among others, already dedicating substantial resources to Canada with multi-billion dollar investments in battery manufacturing and mining and mineral processing projects, Canada is well on its way to becoming a global leader in the new value chain.

The support from all levels of Canadian government demonstrates a commitment to supporting the entire EV supply chain, including the critical mineral sector. From supporting mining operations determined to ethically capitalize on new exploration efforts, the development of infrastructure that will unlock new zones and allow operations to proceed all-season, the construction of new manufacturing plants, and every step in between, Canada looks set to ensure that businesses will have the tools they need to begin and grow their operations in the country.

[2] https://natural-resources.canada.ca/our-natural-resources/minerals-mining/minerals-metals-facts/lithium-facts/24009

[3] https://natural-resources.canada.ca/our-natural-resources/minerals-mining/minerals-metals-facts/cobalt-facts/24981

[4] https://natural-resources.canada.ca/our-natural-resources/minerals-mining/minerals-metals-facts/nickel-facts/20519

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Gowling WLG professionals will be pleased to discuss resolutions to specific legal concerns you may have.