Parna Sabet-Stephenson

Partner

Leader of Financial Services & Technology (FSxT)

Article

1

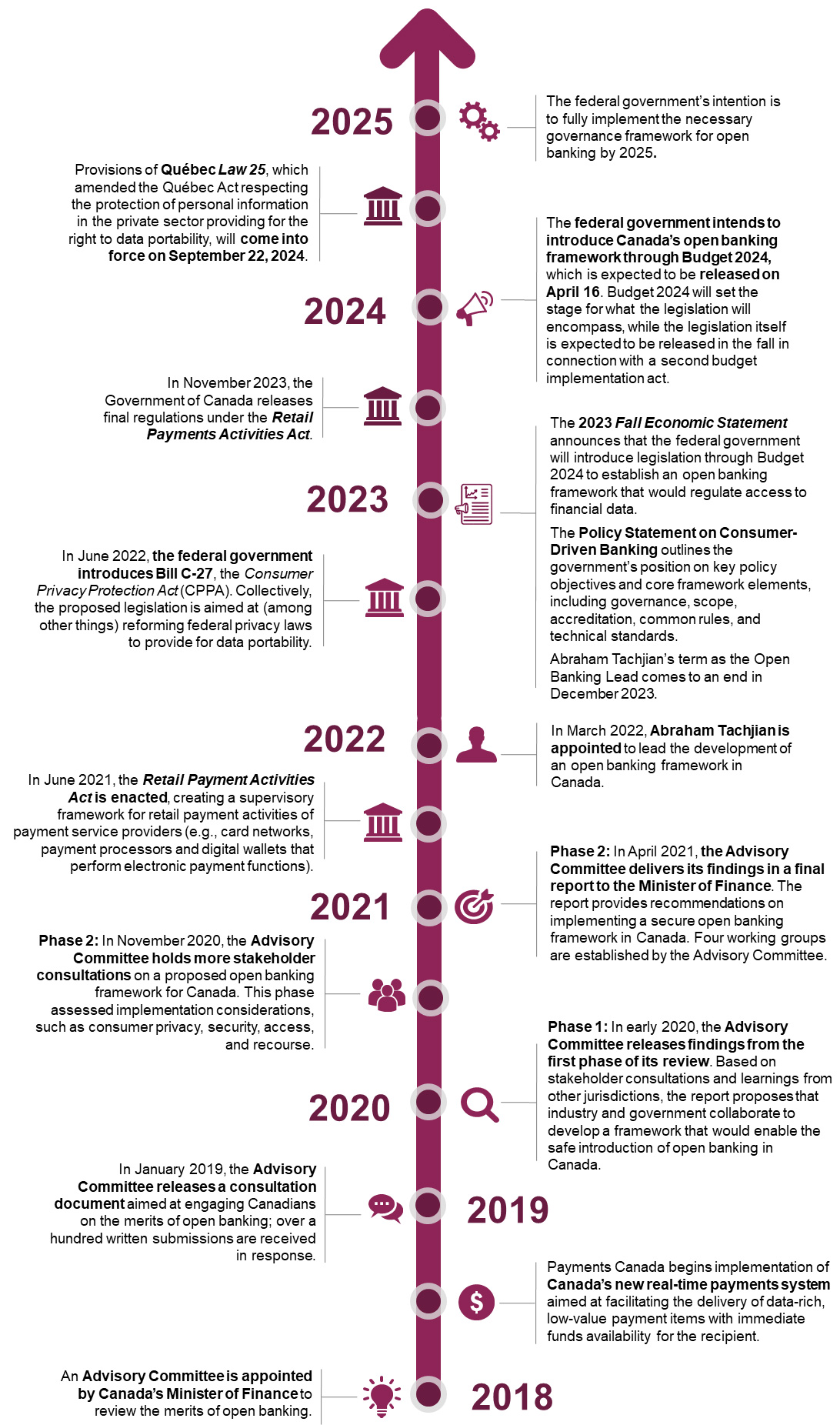

Payments Canada begins implementation of Canada's new real-time payments system aimed at facilitating the delivery of data-rich, low-value payment items with immediate funds availability for the recipient.

In January 2019, the Advisory Committee released a consultation document aimed at engaging Canadians on the merits of open banking; over a hundred written submissions are received in response.

Phase 2: In November 2020, the Advisory Committee holds more stakeholder consultations on a proposed open banking framework for Canada. This phase assessed implementation considerations, such as consumer privacy, security, access, and recourse.

Phase 2: In April 2021, the Advisory Committee delivers its findings in a final report to the Minister of Finance. The report provides recommendations on implementing a secure open banking framework in Canada. Four working groups are established by the Advisory Committee.

In June 2021, the Retail Payment Activities Act is enacted, creating a supervisory framework for retail payment activities of payment service providers (e.g., card networks, payment processors and digital wallets that perform electronic payment functions).

In June 2022, the federal government introduces Bill C-27, the Consumer Privacy Protection Act (CPPA). Collectively, the proposed legislation is aimed at (among other things) reforming federal privacy laws to provide for data portability.

The 2023 Fall Economic Statement announces that the federal government will introduce legislation through Budget 2024 to establish an open banking framework that would regulate access to financial data.

The Policy Statement on Consumer-Driven Banking outlines the government's position on key policy objectives and core framework elements, including governance, scope, accreditation, common rules, and technical standards.

Abraham Tachjian's term as the Open Banking Lead comes to an end in December 2023.The federal government intends to introduce Canada's open banking framework through Budget 2024, which is expected to be released on April 16th . Budget 2024 will set the stage for what the legislation will encompass, while the legislation itself is expected to be released in the fall in connection with a second budget implementation act.

Provisions of Québec Law 25, which amended the Québec Act respecting the protection of personal information in the private sector providing for the right to data portability, will come into force on September 22, 2024.

The federal government's intention is to fully implement the necessary governance framework for open banking by 2025.

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Gowling WLG professionals will be pleased to discuss resolutions to specific legal concerns you may have.