While concern undoubtedly persists across the board about the potential business implications of Britain leaving the EU, it appears that US health product manufacturers and providers are broadly taking a more optimistic view. Indeed, nearly half of the health product businesses in our survey indicate that the uncertain regulatory climate is actually positively influencing the trade and investment decisions they are making right now and they are the most positive of all the sectors polled about the potential impact of the two year Brexit negotiation period on their business activity.

Such positivity is no doubt being driven by the UK's continuing status as a leading provider of health and care services, which is renowned overseas for robust infrastructure, world-leading healthcare institutions and high quality care. That won't change regardless of Britain's chosen Brexit path and there will, of course, still be a buoyant, ongoing need for access to the high quality diagnostic tools and devices provided by US companies after Britain has exited the EU.

Furthermore, gaining approval for and use of a medical product in the UK is still rightly seen as an excellent 'reference site' and a lucrative route to wider international export markets in Africa and Asia. That again will endure, so it's unsurprising that this was among the least likely sectors in the survey to be considering a move away from the UK and least likely to bypass the UK as a result of Brexit. In addition, any direct trade deal between the UK and US would bring much-needed certainty to the relationship, as well as a host of other spin-off benefits so it's understandable to see that almost 83% of respondents would favour such a move.

A further factor driving the lighter mood may well be the perceived current over-regulation within EU healthcare markets and the sense that any new UK regime might roll back on some of the more bureaucratic elements of the product regulation process. For example, product labelling challenges were specifically cited in the survey as being the strongest current, non-tariff barrier that health product firms face when trading, investing or providing services into the EU. This is slightly counter-intuitive since one might expect a degree of nervousness on the part of US suppliers in having to deal with a new UK regulatory system in addition to the existing EU system. Were the UK to go its own way on regulation, there is indeed scope to simplify some of the more onerous aspects of the product regulation process. However, safety concerns will be paramount in any new regime and so we would be unlikely to see significantly relaxed standards. That, ultimately, may well be a case of wishful thinking on the part of the organisations we canvassed.

While uncertainty reigns over Britain's post-Brexit future, it appears that US health products businesses are keeping their powder dry for now. It will certainly be interesting to see if this continues should Brexit negotiations look like they may extend nearer to and perhaps even beyond 2020.

Robert Breedon, partner at Gowling WLG and Head of the Health and Care Sector

The following graphs highlight how US businesses with a turnover of $13 million or above are already reacting and preparing for Brexit.

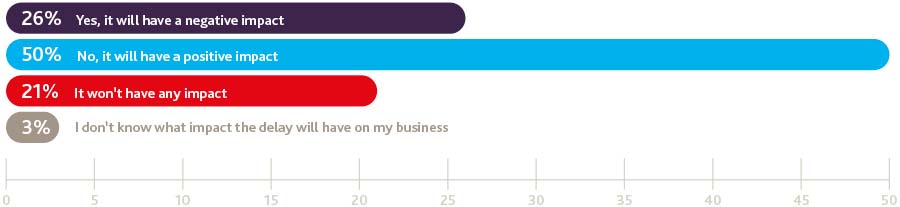

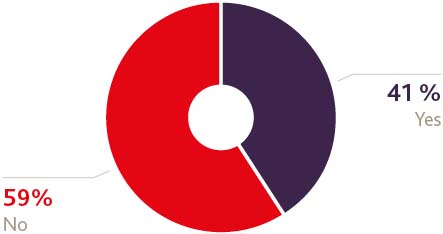

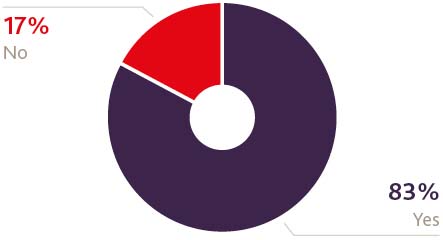

Do you think the delay of up to two years (or possibly longer) for the UK to negotiate an exit from the EU will have a negative impact on your business?

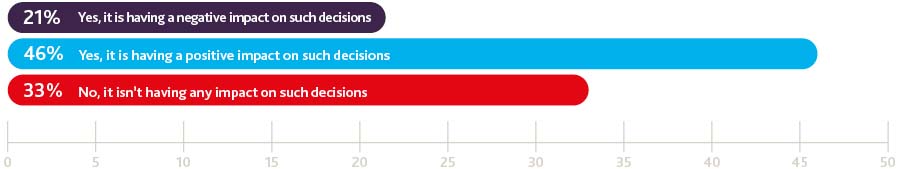

Is uncertainty about the future regulatory environment affecting decisions you are making about trade and investment with the UK right now?

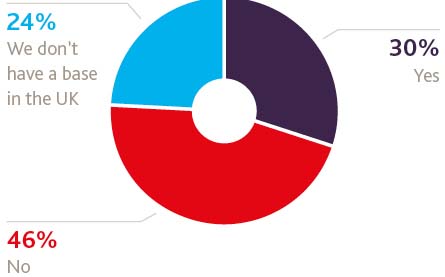

If you have a base in the UK, are you considering moving it to elsewhere in the EU as a result of Brexit?

Are you more likely to bypass the UK in order to do business with the rest of the EU as a result of the Brexit vote?

Would you favour a direct trade deal between the US and the UK?

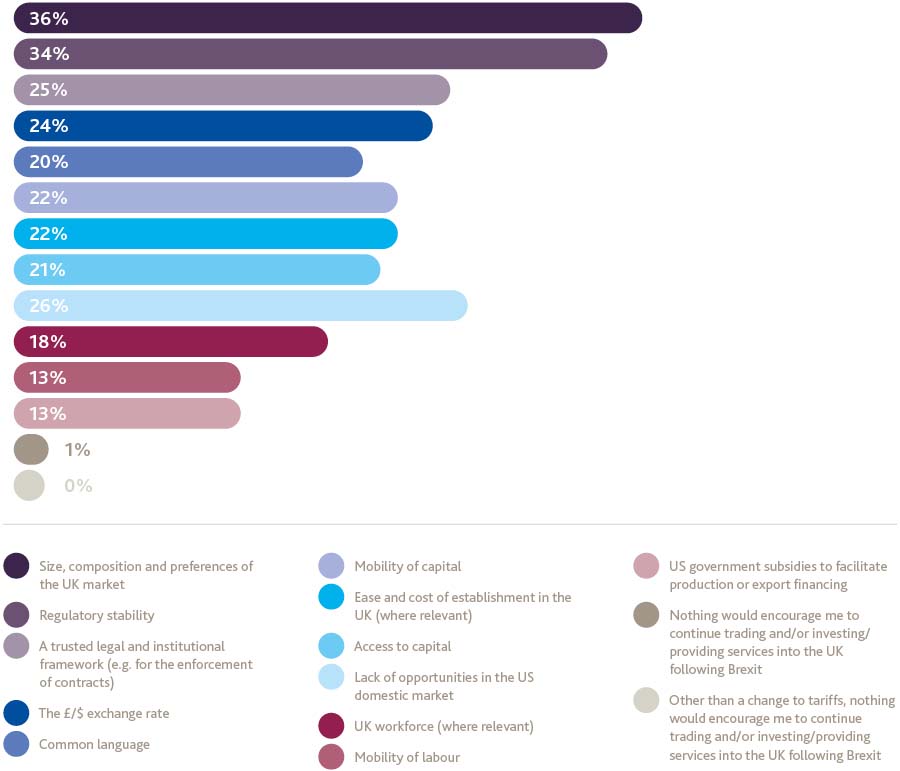

Other than a change to tariffs, what factors would encourage you to continue trading and/or investing/providing services into the UK following Brexit