Stuart Young

Partner

Practice Group Leader - Corporate, Finance and Tax

Article

The outcome of the UK's EU referendum has certainly created a degree of uncertainty among US automotive businesses, with almost half (45%) being concerned about the negative impact of potentially protracted negotiations on their organisation. However, our research shows most are adopting a 'wait and see' approach, with the overwhelming majority making no changes to their investment strategy.

In the immediate aftermath of the Brexit vote, the outcome of the Nissan negotiations was an important PR victory for the UK automotive industry. While we do not know the details of the government's negotiations with Nissan, it was particularly helpful in promoting the 'open for business' message. However, it remains to be seen how the next wave of vehicle production decisions go with other manufacturers - a favourable outcome is vital in supporting the long-term health of the UK's established automotive supply chain.

In the lead up to the referendum, the automotive sector in the UK was enjoying a period of good health with manufacturing and sales figures from the Society of Motor Manufacturers & Traders (SMMT) showing a steady, upward trajectory. However, with a heavy reliance on export sales, there is a need for strong and continued support from the government to ensure the sector doesn't catch a cold in the midst of uncertainty.

There are two main issues the sector is looking for clarity on:

The UK's automotive supply chain is integrated throughout Europe, with components being assembled across multiple borders. If UK-based supply chain companies are to retain their significant role in this process and trade seamlessly across Europe, the Customs Union must remain intact. Similarly, a positive outcome on tariffs is required if the UK automotive sector is to remain competitive.

The sector relies heavily on a diverse workforce, drawn from many EU countries. A strong skills base is crucial for the future growth and development of the UK's automotive industry and there needs to be clarification on what a post-Brexit environment will look like in terms of building a viable workforce.

Despite these uncertainties, the current strength and innovation seen in the UK's automotive sector puts it in a strong position to weather a period of uncertainty. There is also a willingness among international brands with a strong presence in the UK to preserve the status quo. For example, the Japanese were quick to make contact with the UK to outline how they would like to move forward once the UK leave the EU. So far we can be encouraged by the UK's government's support for the sector, but this must be backed up with decisive action to preserve both manufacturing and the thriving export market.

Stuart Young, partner at Gowling WLG and Head of the Automotive Sector.

The following graphs highlight how US businesses with a turnover of $13 million or above are already reacting and preparing for Brexit.

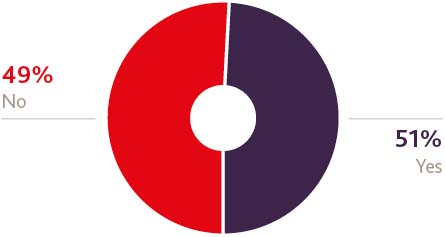

Do you think the delay of up to two years (or possibly longer) for the UK to negotiate an exit from the EU will have a negative impact on your business?

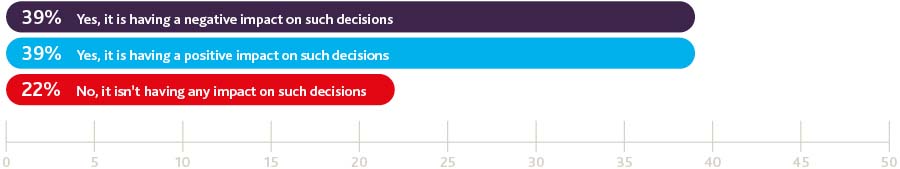

Is uncertainty about the future regulatory environment affecting decisions you are making about trade and investment with the UK right now?

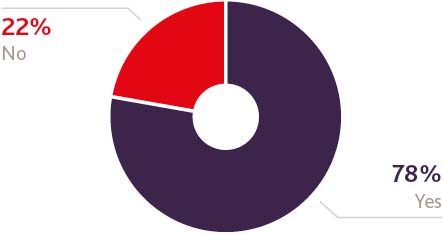

Are you more likely to bypass the UK in order to do business with the rest of the EU as a result of the Brexit vote?

Would you favour a direct trade deal between the US and UK?

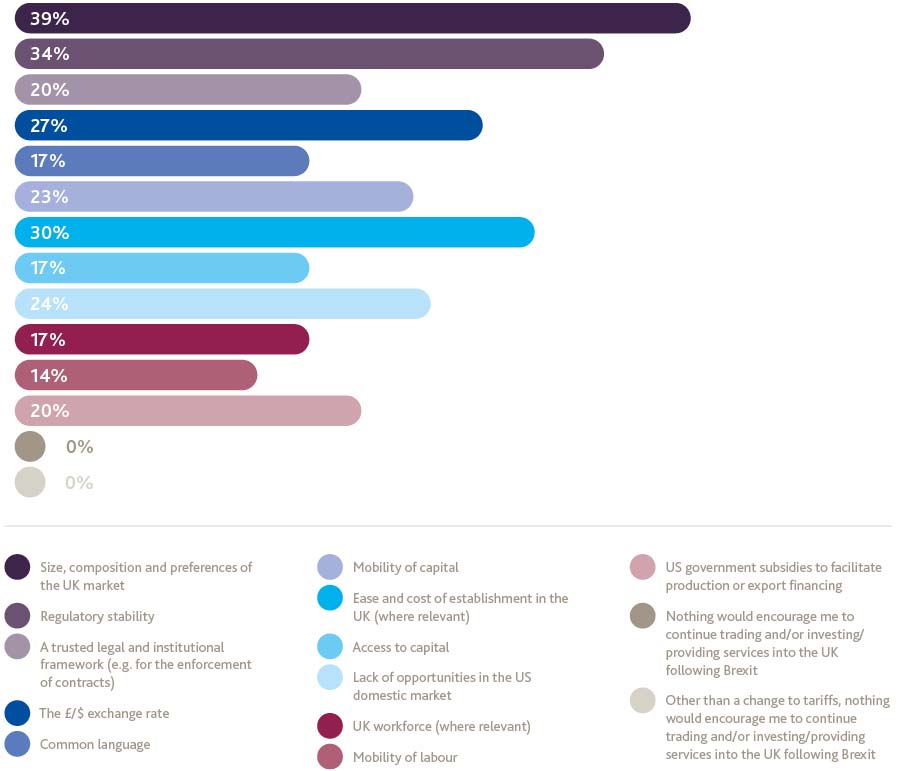

Other than a change to tariffs, what factors would encourage you to continue trading and/or investing/providing services into the UK following Brexit?

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Gowling WLG professionals will be pleased to discuss resolutions to specific legal concerns you may have.