Article

A banker asked us: Changes to provisions regarding movable hypothecs on bank deposits in Québec

6

Q: What relevant changes will Bill 28 bring to movable hypothecs on bank deposits in Québec?

A: On April 21, 2015, the government of Québec adopted An Act mainly to implement certain provision of the Budget Speech of June 4, 2014 and return to a balance budget in 2015-2016 (“Bill 28”). In a previous bulletin, we covered amendments relating to hypothecs granted in favour of a “fondé de pouvoir”. We will now focus on the amendments relating to a movable hypothec with delivery on bank deposits, which amendments will enter into force on Jan. 1, 2016.

Currently, the system that applies to movable hypothecs with delivery on bank deposits is the same as the system that applies to hypothecs on claims found at articles 2710 to 2713 of the Civil Code of Québec (“CCQ”). Following the adoption of Bill 28, a new section comprised of articles 2713.1 to 2713.9 is added to the CCQ. Those articles were inspired by section 9 of the Uniform Commercial Code (“UCC”) in effect in the United States. It must be noted that the articles of the CCQ relating to conflict of laws relating to securities on bank deposits are also amended by Bill 28.

Under article 2713.1 CCQ, the concept of “monetary claim” was introduced. Such concept is defined as “any claim requiring the debtor to reimburse, return or restore an amount of money or make any other payment in respect of an amount of money”. As an example, a monetary claim could be a money deposit with a financial institution or an amount deposited as security. Although this definition seems quite broad, some claims are specifically excluded, such as a claim represented by a negotiable instrument, a security or a security entitlement and claims resulting from the delivery of certain and determinate currency whose repayment must be made by restitution of the same currency. Furthermore, the mechanisms to obtain control further limit the application of the definition of “monetary claim”.

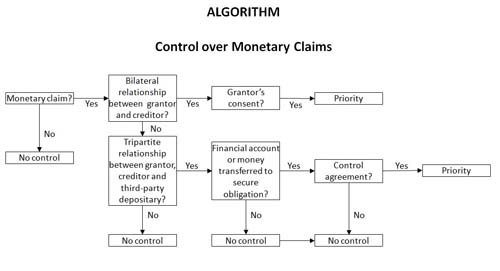

In order to obtain control of a monetary claim, the creditor may proceed in two (2) different ways:

- By obtaining control of a claim that the grantor has against the creditor (bilateral relationship where the creditor is the depositary of the amount of money; for example, a lender who receives deposits and a creditor who receives security deposits); or

- By obtaining control of a claim that the grantor has against a third party (tripartite relationship where the creditor is not the depositary of the account; for example, a creditor whose claim is guaranteed by the balance of an account deposited at a third party bank).

Within the context of a bilateral relationship, the creditor will obtain control of a monetary claim if the grantor consents to the claim guaranteeing the execution of his obligation towards the creditor. A written consent is not required.

In the context of a tripartite relationship, the creditor may obtain control of a monetary claim in the two (2) following cases, but only if the claim relates to a financial account maintained by the third person for the grantor or the claim relates to an amount of money transferred to the third person to secure the performance of an obligation towards the creditor:

- The creditor has entered into an agreement with the third party and the grantor, called a control agreement, by which the third party agrees to comply directly with the creditor’s instructions; or

- The creditor becomes the account holder of the financial account that is the object of a monetary claim relating to its balance.

A hypothec on a monetary claim shall be published and shall take rank from time of control and will rank ahead any other hypothec without delivery relating to the same claim. Furthermore, the control obtained within the context of a bipartite relationship will rank ahead of any hypothec obtained within the context of a tripartite relationship.

In practice, this modification will have a favourable effect for depositary banks since their claim will have priority over any other claim from a third party relating to the affected accounts, whether the claim is registered or not at the Québec Register of Personal and Movable Real Rights. Those modifications will also be advantageous for lessors, since they will have priority over the security deposits of their lessees. There is no doubt that the practical consequences of the entry into force of Bill 28 will need to be further analyzed by practitioners.1

1 The attached algorithm sets out the different control arrangements that may arise.

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Gowling WLG professionals will be pleased to discuss resolutions to specific legal concerns you may have.