Article

Movitex reinvents the EBO

7

The transfer of control of a business during the redeployment phase is a particularly delicate exercise, requiring a careful balance in the calibration of the economic and financial elements of the business plan and the associated resources.

Nevertheless, disposing of all share capital for the symbolic price of one euro opens up many possibilities as regards the involvement of employees in the takeover project.

Two recent examples illustrate this situation: the takeovers of La Redoute and of Movitex (which trades under the Daxon and Balsamik brands) by their management. These are two companies involved in distance selling from the Redcats fold (the Kering group, formerly Pinault Printemps Redoute), where the employee ownership process concluded in late April.

We will look at the example of Movitex, a company with more than 350 employees, where the opening up of the share capital was designed and realised as a genuine EBO (employee buyout) that however took the form of a standard industrial takeover.

The philosophy of the ownership scheme used

Employee ownership promotes motivation, continuity and reward. It aims to develop involvement through a sense of sharing in the common good and ensuring long-term employee loyalty.

Translating employee ownership into legal form, i.e. establishing full shareholder status in the immediate or long-term however raises many difficulties, related in no small part to the highly protected status granted by French law to "small shareholders", whose opposition may obstruct the holding of a meeting or seriously complicate the management of the company. This risk increases with the number of shareholders and with the manoeuvres of any groups that may emerge.

For this reason in particular, ownership on the part of large teams is realised by means of mass measures (often in the form of mutual funds) managed in many cases by professional third parties.

If, under such arrangements, the employee's financial link is maintained with the company from whose expansion he or she is benefiting, the political and quasi-emotional link that is also characteristic of shareholders is in general substantially reduced.

Rejecting the usual approach, the senior management of Movitex designed their own takeover scheme and had the audacity to open up the company's share capital to all group employees, with the idea that each employee could actually become a shareholder without any predetermined exit horizon.

While by no means representing the easiest route, the gamble has paid off: over 85% of Movitex employees expressed the desire to take a stake in the capital alongside the management and today are shareholders.

Implementation and control

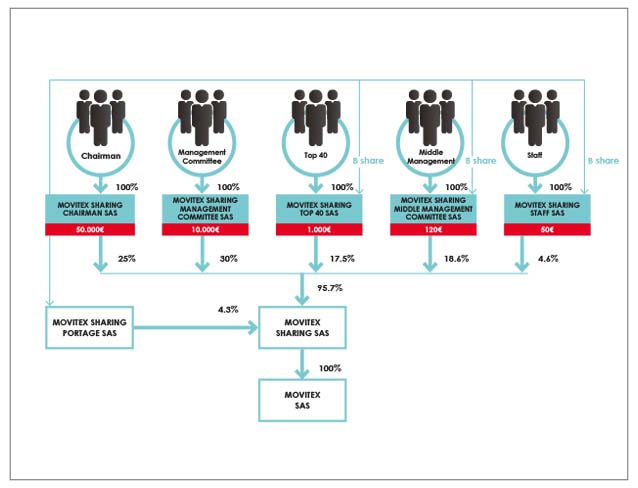

Based on a single price for all, from the chairman right down to the newest member of staff, employees of the Movitex group were classified in job categories (executives, supervisors, employees, etc.) and invited to subscribe to ordinary shares in simplified joint-stock companies that were in turn direct investors in the holding company being taken over.

The amounts that could be invested were determined for each category: from 50 euros for employees up to 10,000 euros for members of the management board. These amounts may at first sight seem small, but they should be seen in the light of the fact that the takeover of the company in the redeployment phase, following recapitalisation by the shareholder making the disposal, was for the symbolic price of one euro.

The relevant company for each category will therefore convene the subscribing employees who will approve the company accounts at the general meeting and possess all the standard rights of shareholders, with the exception of the right to dismiss the management, a function performed by the group chairman by means of a controlling "B" share held in each company.

The diagram below summarises the takeover structure for Movitex.

Prior to the employee subscription period, meetings were held at the company headquarters to present the project, offer training on shareholder status and provide exchanges on the rights and obligations of everyone in the proposed arrangement: these meetings were held in an atmosphere of freedom of speech, unity and participation of the employees in the takeover project, perhaps surprising given the numbers involved. The northern location of Movitex was reflected by the famously cheerful solidarity of the Lille area, which found its expression even in topics that were at first sight somewhat technical or off-putting.

Projections for the future

Most employee share schemes offer employees the option to sell their shares at some point in the future. This ranges from 4-5 years for LBO operations to 8-10 years for industrial projects.

One of the original features of the Movitex case is that such liquidation is not guaranteed. This of course does not apply to employees leaving the company, whose shares are redeemed on departure, but rather to disposals by all those shareholders who had assumed the fixed-term planning required by a major operation relating to the share capital and control of the enterprise.

Employees are therefore committed en masse as equity shareholders, whereby they hold the majority stake and the outcome is by no means predetermined. This de facto state of affairs requires the introduction of sustainability mechanisms for the project that will safeguard their interests should the founder for whatever reason disappear.

Here again, the standard principles of management and law have been set aside in favour of collaboration in assuring the transition to a new management that is capable of taking up the reins of the ownership system. If the chairman is obliged to leave the group, a "council of elders" will be established - with members including the board of directors of the holding company and its independent directors, the serving members of the management committee or whose who are good leavers - in order to form an ad hoc board responsible for the transition and to exercise controlling power over the management of all the companies encompassing the employee shareholders, until a successor can be identified to whom the running of the system will be gradually transferred.

As direct shareholders of the companies for each category, employees will therefore be at the heart of these transformations and the general meeting at which they can come together will act as a forum at which to exchange information, views and proposals for forwarding to the extended board.

The management of this arrangement of companies and contractual agreements is undoubtedly less straightforward than in standard schemes organised by means of a mutual fund; but this form of organisation offers a participatory and mutual construct that exposes each participant to business risk while simultaneously granting him or her the right to share in the success with partner status and the right to take the floor, all the time ensuring a common path. We will see if it stands the test of time and whether it can keep its promises as a creator of value in both financial and human terms.

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Gowling WLG professionals will be pleased to discuss resolutions to specific legal concerns you may have.