Patrick Duxbury

Of Counsel

Leader of Life Sciences (UK)

Article

It has been an active year for the UK life sciences sector, with the EU referendum seemingly having no immediate impact on deal activity. As companies in the sector mature and evolve, we have seen collaboration and consolidation driving M&A levels. In short, it appears to be business as usual. This is borne out in our research, which reveals that companies in the life sciences sector are least likely to have changed their UK investment plans in the wake of Brexit.

However, during the past two decades, many of these companies have been the recipients of important European funding and if this were no longer available in post-Brexit UK the shortfall would somehow need to be made up by the government or from the private sector.

The government's commitment to life sciences businesses is encouraging and there was a favourable response from the sector to the recent Autumn Statement, with many welcoming the £4.7 billion of the National Productivity Investment Fund that has been allocated to furthering the UK's position as leader in science and innovation. Crucially, there was also a pledge to review the current tax system to ensure the UK remains an attractive place for scientific businesses to invest.

Interestingly the UK IP Minister recently confirmed the government's intention to press ahead with plans to ratify the Unitary Patent Convention which surprised many given the uncertainty around what the UK's exit from the EU will mean for this potentially important new patent system. This has also been generally accepted by the UK's life sciences sector as a positive step.

The recent opening of the world-class Francis Crick Institute - a cutting-edge biomedical research facility - reinforces the UK's position as a global centre for innovation and successful collaboration. The strength of partnership working in the UK is evident in the recent creation of Achilles Therapeutics, which will focus on the development of cancer immunotherapies. Led by Syncona, the Cancer Research Technology Pioneer Fund, The UCL Technology Fund and with the support of UCL Business and the Francis Crick Institute, it has launched with £13.2m in funding. This is one of a large number of new companies in the sector which have been created in the UK in the last 12 months.

While it is important to look at these examples of success and strength in the sector, a consistent stream of funding for the fledgling businesses is vital if we are to see similar success stories twenty years from now. The life sciences sector is a cornerstone for industrial development and the UK must remain an attractive place to do business. The government has an important role to play in continuing to champion the sector, ensuring the necessary funding and skills base is available for businesses to thrive.

Patrick Duxbury is a partner at Gowling WLG and head of the Life Sciences sector

The following graphs highlight how US businesses with a turnover of $13 million or above are already reacting and preparing for Brexit.

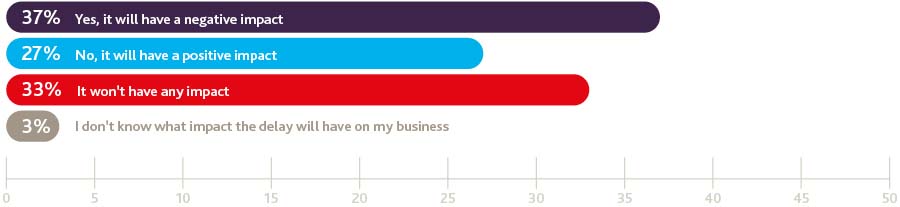

Do you think the delay of up to two years (or possibly longer) for the UK to negotiate an exit from the EU will have a negative impact on your business?

Is uncertainty about the future regulatory environment affecting decisions you are making about trade and investment with the UK right now?

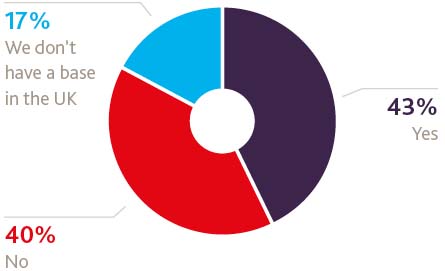

If you have a base in the UK, are you considering moving it to elsewhere in the EU as a result of Brexit?

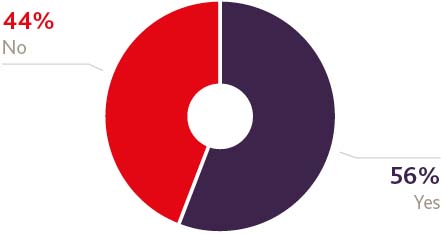

Are you more likely to bypass the UK in order to do business with the rest of the EU as a result of the Brexit vote?

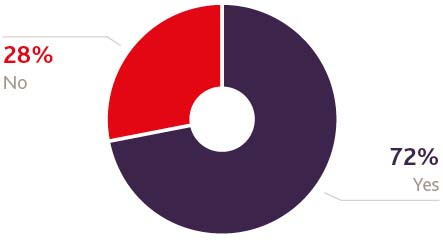

Would you favour a direct trade deal between the US and the UK?

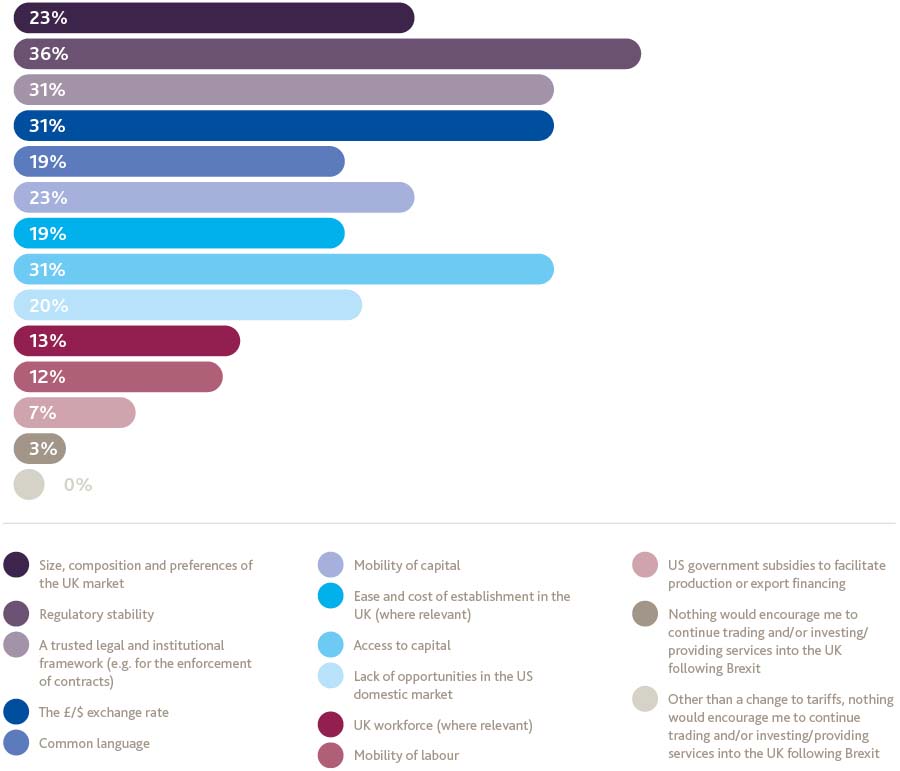

Other than a change to tariffs, what factors would encourage you to continue trading and/or investing/providing services into the UK following Brexit

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Gowling WLG professionals will be pleased to discuss resolutions to specific legal concerns you may have.