Article

Anticipating the tax implications of Brexit

11

While it is still too early to take a position on the actual consequences of Brexit, the main tax implications for groups with operations both in France and in the UK can and should already be anticipated. Notably, Brexit's entry into force will call the application of the EU legislation and regulatory system into question in the UK. One therefore wonders whether the numerous double tax treaties entered into by the UK will be sufficient to compensate for the disappearance of the tax benefits resulting from the EU legislation.

The below provides an overview of the main identifiable tax impacts of Brexit.

1. The impact on withholding tax (WHT): end of the application of the "Parent-Subsidiary" and "Interest and Royalties" Directives and return to conventional rates

The tax treatment of dividends, interest and royalties has been largely influenced by the Parent-Subsidiary Directive[1] and the Interest and Royalties Directive[2] which would no longer be applicable after Brexit.

From a French tax standpoint, the impact of Brexit on these flows can be summarized as follows:

| Before Brexit | After Brexit | |

|---|---|---|

| Dividends from France to the UK | 0% WHT for shareholding >5% | 15% WHT for shareholding btw 5% and 10% 0% for shareholding >10% |

| Dividends from the UK to France | Tax exempt except for a 5% lump sum reduced to 1% if (notably) the French company holds >95% of the UK subsidiary | Tax exempt except for a 5% lump sum unless the UK joins the European Economic Area (EEA) |

| Interest | 0% WHT | 0% WHT |

| Royalty | 0% WHT | 0% WHT |

2. The impact for tax consolidation groups

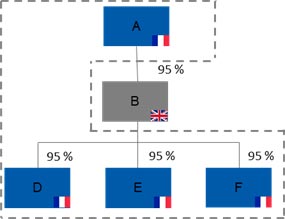

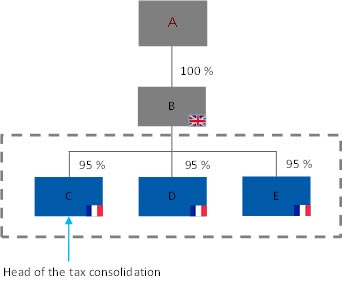

As a reminder, since the famous "Papillon"[3] judgment of the Court of Justice of the European Union (CJEU), French subsidiaries held through a subsidiary located in the EU or EEA may be tax consolidated with the other French companies.

In addition, since 2014, French sister companies whose joint parent entity is established in the EU or EEA can form a tax consolidated group ("horizontal tax consolidation").

Brexit should trigger the termination of the existing "Papillon" and horizontal tax consolidated groups, except if the UK joins the EEA immediately after exiting the EU. The potential impacts and costs of these terminations should be anticipated (e.g. de-neutralisations of intra-group transactions, indemnity to be paid between consolidated entity), notably to limit them to the extent possible (e.g. by transferring the shares of French companies to ensure the continuity of existing French tax group).

Similar consequences should be anticipated in EU countries having similar "Papillon" and horizontal tax consolidation systems.

3. More generally, it means the end of the benefits derived from the application of European directives

In addition the impact on the Parent-Subsidiary Directive and the Interest and Royalties Directive, Brexit would called into question the application of the:

- "Mergers" Directive[4] which organises the tax neutrality of mergers and similar transactions (spin-off, partial contributions of assets) between companies from different Member States. However, Brexit's impact should be limited since the tax neutrality set by Article 210 A of the FTC also applies to operations with a company located in a State which has concluded a double tax treaty (DTT) with France containing an administrative assistance clause, which is the case of the UK-France DTT. Therefore, cross-border transactions with the UK should continue to be eligible for the tax favourable regime when the conditions are met.

- The various VAT Directives[5] which are intended to harmonise the taxation rules in the EU (e.g. application of preferential rates on certain products and services, reverse charge mechanism, exemptions). Consequently, acquisitions and deliveries of products or services between France and the UK should no longer be treated as intra-Community acquisitions and deliveries but as imports and exports outside the EU, making the administrative management of transactions between the EU and the UK more complex and cumbersome (compulsory appointment of a tax representative, VAT refund procedures, adaptation of working tools such as ERP, invoicing system). Similarly, trade flows should be subject to customs duties.

- The Directive on the automatic exchange of information and assistance in the recovery of tax claims[6]. However, the new automatic information exchange standard and the multilateral convention on mutual assistance in tax matters[7] should, in theory, take over from the directive and thus at least potentially compensate for the disappearance of the directive.

- Directive applicable to registration fees[8], which regulates the exemption from registration fees for capital increases between companies of different Member States.

4. Other effects of Brexit to consider in France

Beyond the consequences mentioned above and the necessary adaptation of British domestic tax law, more broadly, for companies, Brexit should have an impact on many French tax systems, notably:

- Expenses incurred by French companies for their research operations outsourced to companies located in the UK should no longer be eligible for the French R&D tax credit, unless the UK joins the EEA;

- Subsidiaries or branches of French companies that would be subject to tax in the UK for an amount of less than 50% of the taxes that it would have borne should it have been domiciled or established in France, would be taxable in France by virtue of French CFC rules (art. 209 B of the French tax code), except if the taxpayer demonstrates that the main purpose of the localisation of its subsidiaries in the UK was not to benefit from this favourable tax regime. Before Brexit, the EU safeguard provision transferred the burden of proof on the tax authorities;

- Exemption for deferred capital gains or tax deferment in the event of a transfer of a company's registered office to an EU Member State should no longer apply to relocations to the UK.

Any EU country conditioning certain tax benefits to the localisation in the EU of an expense / income / operation may no longer provide such benefit to UK-located operations. This needs to be checked on a country-by-country basis.

On the contrary, Brexit should not have any impact on transfer pricing since it is mainly governed by tax treaties and Organisation for Economic Co-operation and Development (OECD) guidelines which will remain in place.

In light of the above, while Brexit will undoubtedly disturb and make future relations more complex between the UK and the EU Member States, the UK could compensate for the loss of Community benefits by introducing a (very) advantageous tax policy.

This change in tax environment could also modify the strategy for setting up European holding companies despite the privileged status they currently hold in the UK, notably to continue benefiting from the benefits / protections offered by the EU Directives and the case law of the Court of Justice of the EU.

Footnotes

[1] Council's Directive 2011/96/EU of 30 November 2011 on the common tax system applicable to parent companies and subsidiaries of different Member States;

[2] Council's Directive 2003/49/EC of 3 June 2003 on a common tax system applicable to interest and royalty payments made between associated companies of different Member States.

[3] ECJ, judgment of 27 November 2008, Case C 418/07

[4] Council's Directive 90/434/EEC on the common tax system applicable to mergers, divisions, transfers of assets and exchanges of shares as regards companies of different Member States;

[5] Council's Directive 77/388/EEC of 17 May 1977 on the harmonization of the laws of the Member States relating to turnover taxes - Common system of value added tax: uniform basis of assessment (repeatedly amended);

[6] Council's Directive 2014/107/EU of 9 December 2014 amending Directive 2011/16/EU as regards the automatic and mandatory exchange of information in the field of Tax;

[7] Multilateral Convention for the Implementation of Tax Treaty Measures to Prevent the Erosion of the Tax Base and the Transfer of Profits of 7 June 2017.

[8] Council Directive 69/335/EEC of 17 July 1969 concerning indirect taxes on the raising of capital;

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Gowling WLG professionals will be pleased to discuss resolutions to specific legal concerns you may have.