Parna Sabet-Stephenson

Partner

Leader of Financial Services & Technology (FSxT)

Article

3

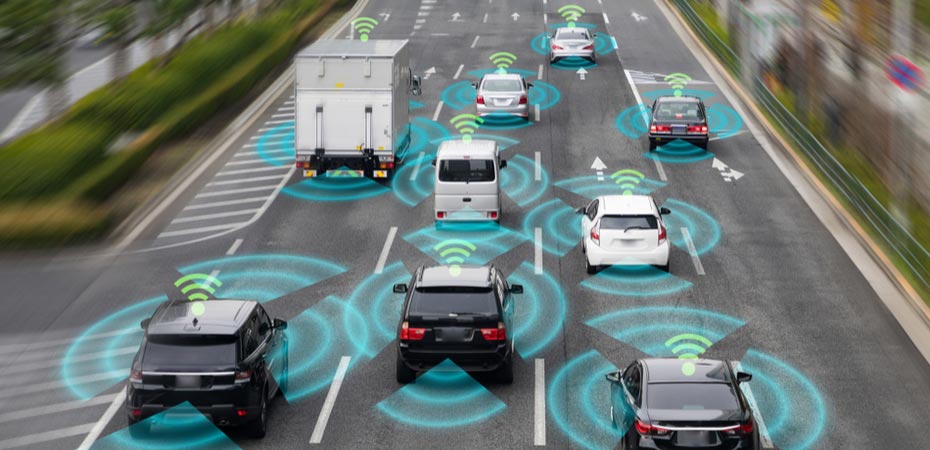

A new report by the Insurance Bureau of Canada (IBC), representing Canada's private property and casualty insurers, argues that fully automated vehicles - the advent of which could begin as early as 2020 - present new risks to the Canadian auto insurance sector and its stakeholders. To mitigate effectively against these risks, IBC calls for fundamental changes to both provincial insurance laws and federal vehicle safety standards.[1]

Current auto insurance is premised on the notion that human error is the primary cause of collisions. As humans cede control of the wheel, responsibility effectively shifts from human error to technological malfunction. IBC identifies four different impacts on the auto insurance industry that will accompany this evolution:

IBC's suggests addressing these impacts through focusing on two key areas:

***

Implementation of IBC's recommendations requires collaboration between provincial and federal governments and regulators, insurers and other stakeholders. IBC urges them to begin this work now.

[1] Insurance Bureau of Canada, "Auto Insurance for Automated Vehicles: Preparing for the Future of Mobility", 2018

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Gowling WLG professionals will be pleased to discuss resolutions to specific legal concerns you may have.