Laura Gheorghiu

Partner

Article

31

Changes to the rules related to the Québec Sales Tax (QST) may mean that your company is now required to collect the QST on sales even if you have no connection to Québec. This will be the case if your company:

The Québec rules requiring non-residents of Québec to collect and remit Québec Sales Tax ("QST") on digital goods and services and, in certain cases, on tangible property came into effect on January 1, 2019. These new rules have consequences for transactions conducted with Québec consumers by businesses domiciled both in the rest of Canada and beyond its borders.

Under the new rules, assuming that the minimum threshold is satisfied, non-resident suppliers are required to register under a separate registration system and to collect and remit QST on taxable supplies made to Québec consumers. This collection requirement applies in respect of supplies of incorporeal movable property (intangible property) and services made by non-residents of Canada and, in the case of non-residents that are located in Canada but outside Québec, also applies to supplies of corporeal movable property (tangible property). Digital platforms that provide services to a non-resident supplier enabling it to make supplies of incorporeal movable property or services to Québec consumers are subject to the registration and QST collection requirements in the place of the non-resident supplier, where the platform controls the key elements of the transactions.

Registration, collection, reporting, and remittance obligations under the new regime will be simplified and conducted exclusively through an electronic platform operated by Revenu Québec, which can be accessed here.

The Québec Ministry of Finance has promised a practical approach to compliance that would be corrective rather than punitive and will offer leniency during the first twelve months of its application.

For ease of understanding, please refer to the Definitions section for the meaning of the technical terms used in this text and the applicable sections of the Act Respecting the Québec Sales Tax ("QSTA").

Canadian Specified Supplier means a supplier who 1) does not conduct business in Québec, 2) has no permanent establishment in Québec, 3) is not registered under the General Regime, and 4) is Goods and Services/Harmonized Sales Tax ("GST/HST") registered (s. 477.2 of the QSTA).

CMP means corporeal moveable property (tangible property).

Consumer, see definition at part 5 of this test (s. 1 of the QSTA).

Foreign Specified Supplier means a supplier who 1) does not conduct business in Canada, 2) has no permanent establishment in Canada, and 3) is not GST/HST registered (s. 477.2 of the QSTA).

General Regime means the existing registration system set out in Division I of Chapter VIII of the QSTA.

IPP means incorporeal moveable property (intangible personal property).

Québec Consumer means a recipient of a supply who is a consumer whose usual place of residence is in Québec (s. 477.3 of the QSTA).

Specified Digital Platform see definition at part 4.2 of this text (s. 477.2 of the QSTA).

Specified Québec Consumer, see definition at part 5.3 of this text.

Specified Regime means the new registration regime provided for in Division II of Chapter VIII.1 of the QSTA.

Specified Supplier means any supplier who 1) does not conduct business in Québec, 2) has no permanent establishment in Québec, and 3) is not registered under the General Regime (s. 477.2 of the QSTA).

Specified Threshold, see definition at part 4.2 of this text.

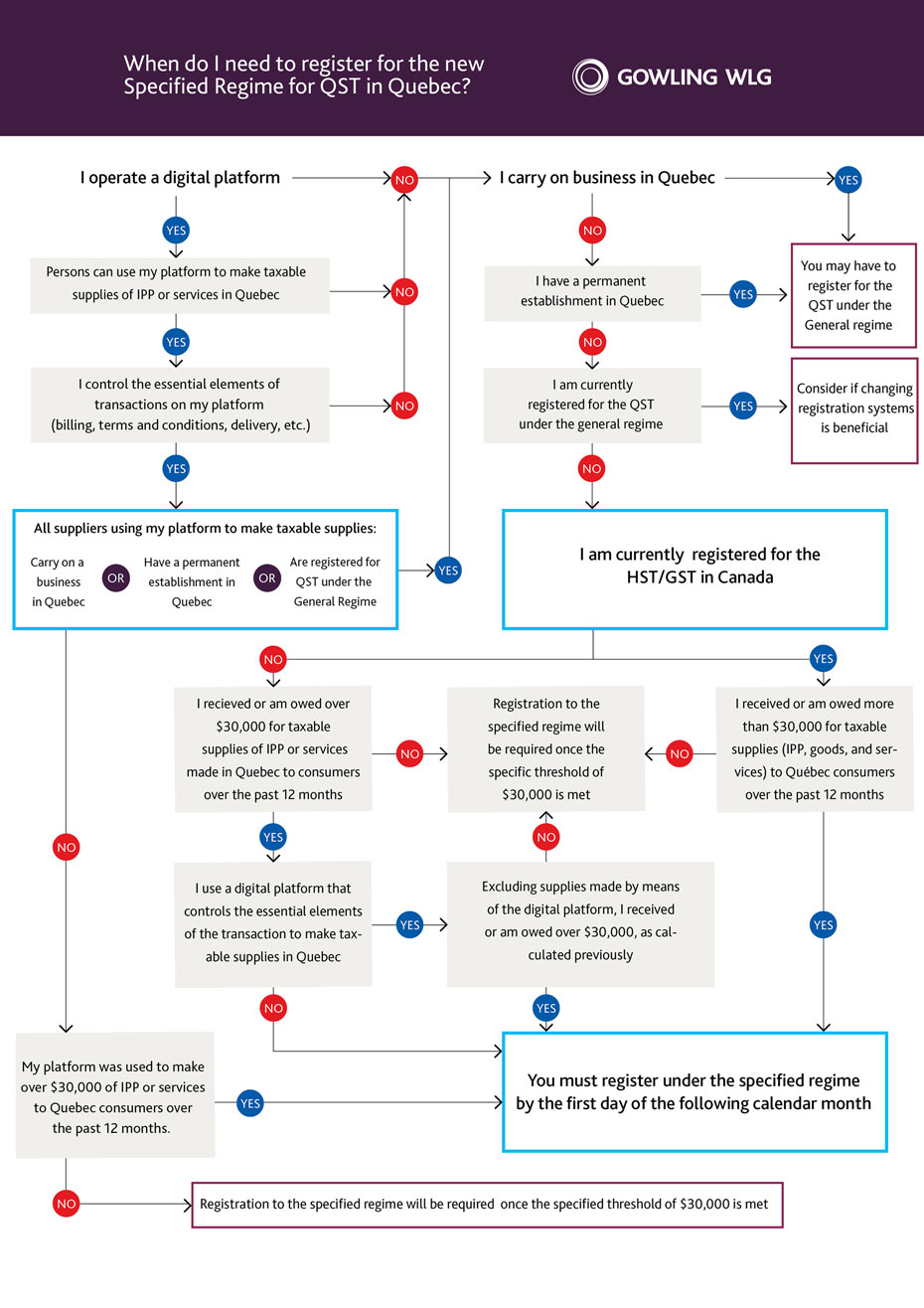

Use the flowchart below to determine if your business is required to register under the Specified Regime.

The obligation to register under the Specified Regime is triggered on the first day of the calendar month during which the Specified Threshold of the Specified Supplier or the Specified Digital Platform exceeds CAD$30,000. If the Supply is made in a currency other than Canadian dollars, the value of the consideration in Canadian dollars should be established using a fair, reasonable, and consistent conversion method.

The "Specified Threshold" is the value of the consideration owed to or received by the supplier in a 12-month period for taxable supplies made in Québec to a recipient who can reasonably be considered to be a Consumer. The following types of supplies are considered for the purposes of establishing the Specified Threshold:

A Specified Supplier who only makes supplies of IPP or services through a Specified Digital Platform will not be required to register under the Specified Regime because it will be deemed to have a Specified Threshold of nil.

The different coming into force dates for Foreign Specified Suppliers and Canadian Specified Suppliers discussed in section 8 below, means that in calculating its Specified Threshold for the period from January 1, 2019 to August 31, 2019, a Specified Digital Platform must solely take into consideration only the taxable supplies made in Quebec by Foreign Specified Suppliers.

In order to determine what amounts are counted towards the Specified Threshold, it is important to consider what constitutes a "taxable supply made in Québec", and who is a "Consumer". Please see a discussion of these points below.

Generally, when a non-resident of Québec does not carry on business in Québec for QST purposes and is not registered under the General Regime, any supplies of CMP, IPP or services it makes are deemed to be made outside Québec.

The amendments override this general rule for purposes of determining whether or not the Specified Threshold has been met, so that supplies made in Québec by a non-resident, that would otherwise be deemed to be made outside Québec, will be considered made in Québec for purposes of the threshold. Further, the amendments provide that all supplies of IPP and services made remotely by a Foreign Specified Supplier (note that such suppliers are not required to register for either the GST/HST or the QST under the general regime) to recipients that are Québec Consumers in respect of the supply are deemed to be made in Québec.[1]

A "Consumer" is an individual who acquires, or brings into Québec, the property or service for his personal consumption, use or enjoyment or that of other individual, but not for use or supply in the course of its commercial activities or other activities in the course of which the individual makes exempt supplies.

The author submits that a recipient who provides a business billing address, corporate or partnership name, or the CRA/Revenu Québec business number, or uses a corporate credit card or bank account as a means of payment, is likely not acquiring the property for his personal use or consumption and, therefore, should not be a Consumer.

Further, since the test as to whether a supply is included in the Specified Threshold is based on whether someone can reasonably be considered a Consumer, when a supply is made purely for B2B purposes (ex. enterprise grade software), or is made to a person who is QST registered, one can reasonably conclude that the recipient of said supply is not a Consumer.

A Foreign Specified Supplier is a person who does not conduct business and has no permanent establishment in Canada and has not registered for GST/HST. Such persons would not normally expect to be subject to sales tax obligations in Canada.

Nevertheless, under the new Specified Regime, where such a non-resident supplier makes supplies of IPP or services in Canada, it will need to begin collecting the information discussed in section 5.1 below in order to allow it to establish the timing of its registration obligation under the Specified Regime. It remains to be seen how Revenu Québec will deal with instances where the non-resident supplier has not obtained the information necessary to allow it to make the determination of whether or not the Specified Threshold will be met.

Persons required to register under the Specified Regime can choose to register under the new General Regime.

Optional registration under the General Regime allows input tax refunds ("ITR") to be claimed on the QST paid on supplies acquired for consumption, use or supply in commercial activities. However, it also carries the obligation to also register for the GST/HST. Once these two registrations are obtained, the supplier is required to collect both GST/HST and QST on all taxable supplies made in Canada and not, as described below, just on supplies to Specified Québec Consumers, as is the case of those QST registered under the Specified Regime. Further, it requires the registrant to provide security deemed sufficient by the Ministry of Finance (50% of net tax estimated for the year), and precludes the registrant from accessing the simplified reporting and remitting rules under the Specified Regime.

The table below summarizes certain key differences between the Specified Regime and the General Regime.

| Matters | General Regime | Specified Regime |

|---|---|---|

| The Supplier can claim ITRs on its supplies | YES | NO |

| Obligation for the Supplier to provide documentation to support an ITR claim | YES | NO |

| Obligation for the supplier to be GST/HST registered | YES | NO |

| Quarterly QST returns filed electronically (simplified registration and remittance) | NO | YES |

| GST and QST collection on all taxable supplies | YES | NO |

A Specified Supplier who is registered under the Specified Regime is required to collect and remit QST on the taxable supplies of IPP and services it makes in Québec to Specified Québec Consumers, unless it makes those supplies through a Specified Digital Platform. See the discussion below with respect to who is a Specified Québec Consumer.

If the Specified Supplier is also GST/HST registered (called a "Canadian Specified Supplier"), it will be required to also collect and remit QST on the taxable supplies of CMP to Specified Québec Consumers. In practice, this means that a non-resident of Canada who has voluntarily registered for the GST/HST, for example, in order to recover the GST it pays on the importation of CMP into Canada, is now subject to the same QST collection requirements when it sells CMP to Specified Québec Consumers as a Canadian resident outside Québec.

The following summarizes the conditions to be met in order for QST to be collectible on a supply by a Specified Supplier registered under the Specified Regime.

The Operator of a Specified Digital Platform who collects payment for supplies of IPP or services made by a Specified Supplier to a Specified Québec Consumer is required to collect the QST on those same supplies in the place of the Specified Supplier.

Revenu Québec has also issued guidance advising that the Specified Supplier should obtain proof of QST registration from the Specified Digital Platform in order to not be held responsible for collecting the QST on the supplies it made through the platform.

A "Specified Digital Platform" is a digital platform for the distribution of property or services through which a particular person enables a Specified Supplier to make a taxable supply in Québec of IPP or a service to a recipient, provided the particular person controls the essential elements of the transaction between the Specified Supplier and the recipient, such as billing, the terms and conditions of the transaction and the terms of delivery. A Specified Digital Platform could, for example, intermediate e-commerce transactions such as is the case for music or a smartphone app.

The legislation clarifies that a Specified Digital Platform is a platform that provides a service to a non-resident supplier by means of e-communication (e.g., an application store or a website), enabling the non-resident to make supplies to Specified Québec Consumers. A platform that only provides one of the following services is not considered to control the essential elements of a transaction:

Consequently, a platform that shows local classified ads where the platform does not control any elements of the ensuing transaction may not qualify as a Specified Digital Platform. Likewise, platforms providing enterprise (B2B) solutions may not be required to register under the Specified Regime as they would not meet the Specified Threshold.

The following summarizes the conditions to be met in order for QST to be collectible on a supply by a Specified Digital Platform in the place of the Specified Supplier.

"Specified Québec Consumers" are persons who are not registered under the General Regime and whose usual place of residence, determined in accordance with section 477.3 of the QSTA, is situated in Québec. See part 5.1 below for a discussion on the information that must be collected in order to make this determination.

Unlike the definition of a "Québec Consumer" for purposes of determining if the Specified Threshold for the Special Regime registration is met, the definition of "Specified Québec Consumer" used to determine if QST should be collected on a supply does not require the recipient to be a "Consumer". Consequently, it is not necessary for the Specified Supplier to validate whether or not the individual is acquiring the property or service for his or another individual's personal consumption.

As is the case for registration under the General Regime, once registered for the Specified Regime, a Specified Supplier can no longer rely on the rule that deems supplies made in Québec by a non-resident of Québec who does not carry on business in Québec to be made outside Québec. The place of supply rules for residents of Québec apply instead.

A similar change overrules the deeming rule for supplies made outside Québec by Specified Suppliers who make supplies of IPP and services through a Specified Digital Platform that is QST registered under the Specified Regime.

The amendments further provide that all supplies of IPP and services made remotely by a Foreign Specified Supplier to recipients that are Québec Consumers in respect of the supply are automatically deemed to be made in Québec and, therefore, the analysis of the applicable place of supply does not need to be carried out.

In Bulletin 2019-3, published February 28, 2019, The Québec Government amended the legislation to require a Specified Digital Platform that is already QST registered under the General Regime, or registers under the Specified Regime between January 1, 2019 to August 31, 2019, to collect the QST in respect of all of the taxable supplies of IPP and services that it makes on behalf of both Foreign Specified Suppliers and Canadian Specified Suppliers, even though the rules only come into force with respect to Canadian Specified Suppliers as of September 1, 2019, as discussed in section 8 below.

The amendment, which is applicable as of January 1, 2019, will not apply to supplies of IMP or services made on or before February 28, 2019 by a Canadian Specified Supplier, if the platform has not collected the QST on the supply.

However, as of March 1, 2019, Specified Digital Platforms that are QST registered, effectively immediately submit supplies made by Canadian Specified Suppliers to QST ahead of the September 1 effective date.

To determine the usual place of residence of a recipient of a supply, s. 477.3 of the QSTA provides that the non-resident supplier must obtain, in the ordinary course of its operations, one or two (depending on the purpose, as explained below) non-contradictory pieces of information from among the following:

Where the test is applied to determine whether a recipient is a Specified Québec Consumer, two (2) pieces of non-contradictory information must be obtained. Where there is contradictory information available, reliance should be put on the most reliable piece of information in making the residency determination. What constitutes "reliability" will be open to interpretation and debate. Where two pieces of non-contradictory of information cannot be obtained because of the non-resident supplier's current commercial practices, Revenu Québec may allow a different method to be used.

Where the test is applied in order to determine whether the Specified Threshold is being met, obtaining only one piece of information in support of that conclusion will be sufficient. This being said, given that non-resident suppliers who are not registered under the Specified Regime will not necessarily be aware of their potential registration requirements, it is possible that even this information may be lacking.

Where QST is collected, the following information must be indicated to the recipient on an invoice or receipt or provided in the agreement entered into with the recipient:

In both cases, the QST should be referred to by its name or abbreviation (i.e., QST) and where the rate of the tax is indicated, it should be set apart from the rate of any other tax.

The Specified Regime does not require the supplier to indicate its QST registration number, since the recipient under the Specified Regime cannot claim an ITR.

Non-resident suppliers that anticipate that certain of their customers may be located in Québec, should review their data collection practices to help facilitate potential required compliance with registration, collection and invoicing requirements under the Specified Regime. To this end, they should review their CRM and sale platforms to ensure that they capture sufficient information to i) determine whether or not a recipient is a consumer, ii) determine the place of residence of a consumer, and iii) to avoid collecting tax on supplies made to QST registrants. For suppliers who conduct repeat business, one should consider asking existing clients to update their profiles with the necessary information and to provide their QST registration numbers, if applicable.

Persons registered under the Specified Regime must report and remit QST to Revenu Québec for each calendar quarter. Filing is done electronically and is due one month after each quarter. This is a major simplification, as the General Regime would require entities making more than CAD $6M annual taxable supplies in Canada to report and remit on a monthly basis.

With a view to avoiding double taxation of the same supply within Canada, when a supply has already been subject to value-added taxation in another province and QST is collected under the Specified Regime, the Specified Québec Customer will be eligible for a refund from Revenu Québec upon proof of payment of the GST/HST.

All QST collected in a foreign currency must be converted into Canadian currency at the exchange rate applicable on the last day of the reporting period. It is also possible to elect under section 477.15 of the QSTA to remit the QST collected in a prescribed foreign currency – currently only US dollars and euros.

Finally, Bill C‑13 (Feb. 29, 2019) proposes to allow the election under s. 41.0.1 of the QSTA to permit an agent or billing agent to remit the QST collected on behalf of the supplier.

Québec recipients of CMP or services who attempt to evade the payment of QST under the Specified Regime by providing false information to a Specified Supplier or to the operator of a Specified Digital Platform will incur a penalty equal to the greater of $100 and 50% of the payment which the recipient of the Supply evaded or attempted to evade.

Furthermore, the usual penalties for failure to register for, collect or remit QST provided under the General Regime will apply mutatis mutandis to the Specified Regime.

The Government has announced that it will apply penalties only after 12 months following the coming into force of the aforementioned changes.

The Government understands that enforcement will be a challenge for non-compliant Specified Suppliers outside Canada. Revenu Québec has stated its intention to use the full arsenal of tools available to ensure compliance. This could range from sending garnishment notices to Canadian payors, to filing suit for tax evasion against publicly traded corporations which will be required to disclose the existence of a pending lawsuit and justify their non-compliance to their shareholders. This being so, it remains to be seen whether the potentially extra-territorial nature of certain aspects of the amendments will not face challenge in the medium term.

The changes came into force on January 1st, 2019 for Foreign Specified Suppliers and will come into force on September 1st, 2019 for Canadian Specified Suppliers.

The compliance date for operators of Specified Digital Platforms depends on the coming into force date of the rules for the suppliers that transact using their platform (i.e., January 1st, 2019 with respect to Foreign Specified Suppliers and September 1st, 2019 for all other Specified Suppliers).

Footnotes

[1] See section 5.1 for a discussion of the information that must collected in order to determine the usual place of residence of a Consumer.

[2] s. 477.3 of the QSTA.

[3] s. 477.7 of the QSTA.

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Gowling WLG professionals will be pleased to discuss resolutions to specific legal concerns you may have.