Tim Casben

Partner

Head of UAE offices

Article

8

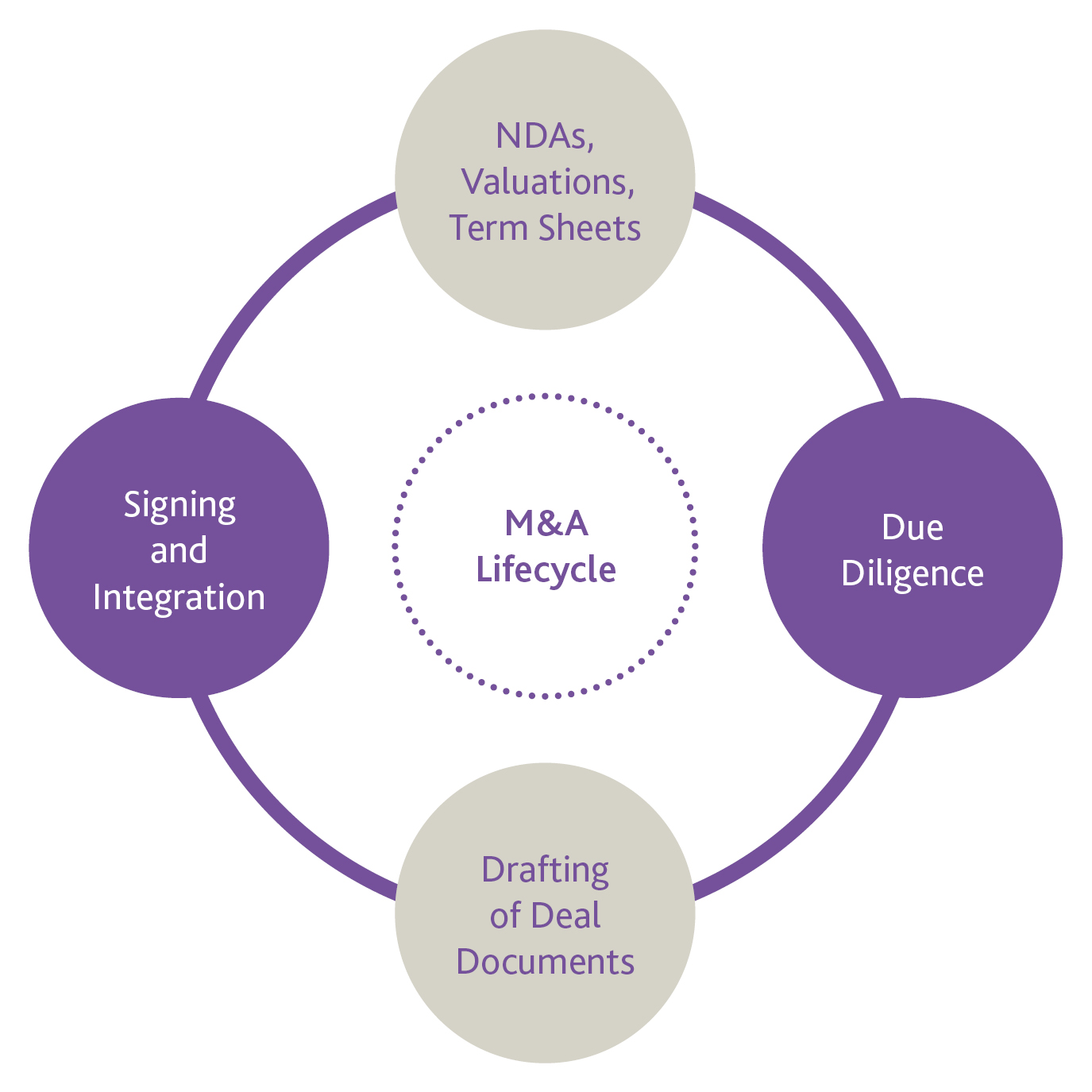

For many individuals, the first they will see/hear of a transaction is a headline such as "XYZ group acquires a majority stake in Target Company or agrees terms for the acquisition of a majority stake in Target Company". However, a lot of work has to be done before documentation is signed and any such announcement can be made, with distinct stages of the M&A lifecycle leading to the ultimate signing of a deal, with simultaneous completion or potentially significant conditions to be satisfied before completion can occur. Over the coming weeks, we will be looking at what these stages consist of and how both buyers and sellers can best prepare themselves for the transaction process.

This part 1 of our M&A lifecycle series looks at the inception of an M&A deal from a legal perspective in the form of NDAs, valuations and term sheets.

As a seller, prior to exchanging any confidential information about your business, a non-disclosure agreement (NDA) should be entered into with any potential buyers. This can be particularly important for a number of reasons, whether protecting trade secrets or the requirement from a regulatory perspective for the fact a transaction is being contemplated to be kept confidential.

There will also be different levels of information that may be particularly sensitive if you are considering selling to a competitor, such as terms with key suppliers or customers.

Having legal input on the form of the NDA and negotiation of this is important to ensure you are adequately protected. If several buyers may be interested, legal advisors can assist with the project management of this, working through mark-ups of NDAs from buyers and ensuring that amendments made are fair (giving due consideration to their commercial needs to consider the transaction), whilst ultimately still protecting confidential information to the greatest extent possible.

From a buyer's perspective, ensuring you can distribute information to your advisors and internal employees, consultants and others who need to know the information will be important. The term for which shared information must be kept confidential should also be considered, to ensure this is fair and appropriate carve-outs should be included in the NDA detailing when information will not be confidential.

You may also consider disclosing information in phases; this might be particularly relevant when considering an auction process. As an example, it would be usual that the most sensitive commercial information is withheld and only released to the preferred bidder towards the end of the process.

One of the key items both buyer and seller will need to consider is how the company is valued. With buyers usually instructing accountants and/or corporate finance advisors to carry out such valuations, they should be advised as to the differing valuation methods that may be used, which can be compared to determine an initial offer price. Any valuation sought should also be subject to the buyer's due diligence, the purpose of which from both an accounting and legal perspective is to confirm that the assumptions that any buyer has made on reaching the valuation are valid and that there are no issues which might adversely affect these, which require an adjustment to the purchase price.

Where the buyer is struggling to arrive at a valuation due to an inconsistent track record, for example following the impact of coronavirus, or where there is a mismatch on the valuation between the buyer and the seller, the buyer may structure the transaction with an earn out where the full consideration is only paid once the target company has hit certain targets. This will depend on whether the buyer is valuing a business on a net asset basis or on the basis of future earnings and can also be particularly relevant for early stage tech companies which might be extremely difficult to value. If a valuation is on a net asset basis, there will often be a provision for post completion adjustments.

Whilst term sheets are usually only partially binding as to costs, confidentiality and exclusivity, their importance should not be overlooked to the transaction lifecycle, and often a poorly drafted term sheet can indicate that not enough thought has been put into an acquisition/sale, and signal issues down the line in negotiating positions on key documents.

It is, therefore, in both parties' interests to ensure term sheets are drafted appropriately, considering what the crucial transaction documents should cover and the overall structure of the transaction. In our experience, a more detailed term sheet can lead to significant savings in time and costs when it comes to drafting and negotiating the transaction documents.

Key items and questions to consider in a term sheet include:

Gowling WLG is well-placed to assist with all aspects of M&A transactions and is consistently ranked for M&A work across the globe. We are able to deliver both cross-border and domestic corporate transactions as part of structured sale processes or off-market deals.

Should you be interested in discussing this further, please contact Tim Casben, Simon Elliott or Beth Bloor.

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Gowling WLG professionals will be pleased to discuss resolutions to specific legal concerns you may have.