David Lowe

Partner

Head of Commercial Contracts

Co-Chair of ThinkHouse

Article

Nowhere are concerns over the potential impact of Brexit on transatlantic business relations being more keenly felt than among US food and drink businesses. Indeed our research shows that when it comes to the decisions companies are making about trade and investment with the UK right now, it's having by far the greatest negative impact in this sector. Given the huge uncertainties surrounding what type of Brexit the UK will pursue and the associated timescales, it is entirely understandable that US businesses weighing up the pros and cons of future business links with the UK are increasingly wary.

By their very nature, food and drink goods are heavy and often cumbersome to transport and there can be huge cost implications throughout the supply chain when cross-border speed of delivery is impaired. As such, any future imposition of tariffs or non-tariff barriers and extra border checks and controls for goods leaving the UK into the EU could have a major impact on the profitability and indeed viability of some US operations. As things stand, a great number of food and drink exports are transported from the UK swiftly and efficiently across to the continent through the Channel Tunnel but with a question mark hanging over Anglo French relations and indeed the free movement of goods and services more generally, this will be causing further concern. It's hardly surprising then that it's the sector in our survey most likely to be considering locating elsewhere in the UK and indeed bypassing it altogether to continue doing business most effectively with EU markets.

The potential for wide-ranging regulatory change as the UK prepares to go its own way is proving yet another cause for concern. Currently, any US food manufacturer that has approval to export and supply a product to the UK can have complete certainty that said item will be fully compliant with all the relevant safety, labelling and packaging requirements in the remaining 27 EU member states. That could easily all change down the line however if the UK were to pursue an independent set of regulatory standards, giving US businesses a further unnecessary headache.

How a post Brexit Britain intends to address the agricultural sector will be key to allaying the fears of food and drink producers across the pond. The current common agricultural policy provides certainty and clarity for all EU members, meaning that the UK can freely export grain to Germany and Poland supply sugar beet to the UK for example. Again, were the UK to change the parameters of the current agreement or indeed be cast out of it altogether this could mean extra regulatory hurdles to navigate. The same goes for fisheries policy, a historically hotly debated issue on which there is significant potential for the UK to attempt to forge its own path.

It all adds up to a confusing and uncertain picture for US and UK food companies alike. While Theresa May has announced her intention to avoid a running commentary on Brexit negotiations, the industry will be watching developments closely, particularly for any clues as to the Government's opening position on how it intends to make Brexit work for business.

David Lowe, Head of International Trade, Brexit Unit; Head of the Food and Beverage Sector and partner at Gowling WLG

The following graphs highlight how US businesses with a turnover of $13 million or above are already reacting and preparing for Brexit.

Do you think the delay of up to two years (or possibly longer) for the UK to negotiate an exit from the EU will have a negative impact on your business?

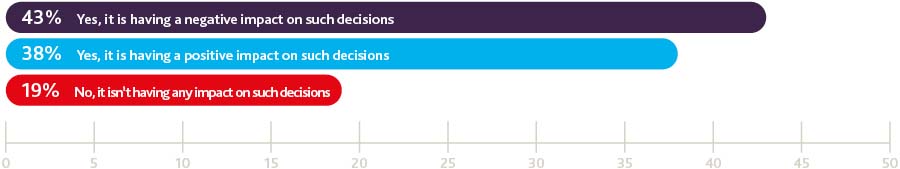

Is uncertainty about the future regulatory environment affecting decisions you are making about trade and investment with the UK right now?

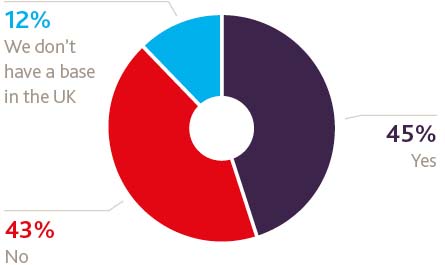

If you have a base in the UK, are you considering moving it to elsewhere in the EU as a result of Brexit?

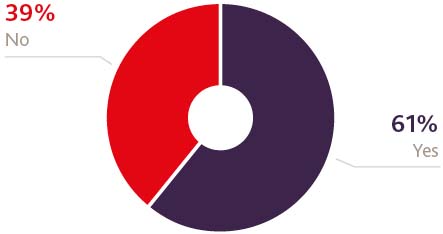

Are you more likely to bypass the UK in order to do business with the rest of the EU as a result of the Brexit vote?

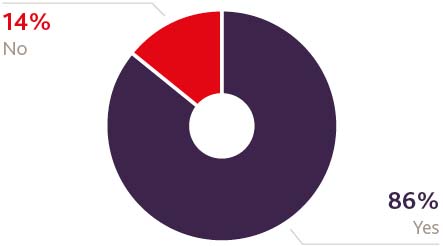

Would you favour a direct trade deal between the US and the UK?

Other than a change to tariffs, what factors would encourage you to continue trading and/or investing/providing services into the UK following Brexit

CECI NE CONSTITUE PAS UN AVIS JURIDIQUE. L'information qui est présentée dans le site Web sous quelque forme que ce soit est fournie à titre informatif uniquement. Elle ne constitue pas un avis juridique et ne devrait pas être interprétée comme tel. Aucun utilisateur ne devrait prendre ou négliger de prendre des décisions en se fiant uniquement à ces renseignements, ni ignorer les conseils juridiques d'un professionnel ou tarder à consulter un professionnel sur la base de ce qu'il a lu dans ce site Web. Les professionnels de Gowling WLG seront heureux de discuter avec l'utilisateur des différentes options possibles concernant certaines questions juridiques précises.