Alexandra Brodie

Partner

IP Litigation

Article

Looking at the immediate and longer term prospects for US tech businesses operating in the UK, it's very much a tale of two halves - right now where all the talent and opportunity is still exactly the same but coupled with a cheap pound and, at the end of the Brexit negotiations, whenever that may be.

As things stand, despite all the prevailing uncertainty caused by the Brexit vote, nothing has actually changed from a regulatory perspective and with a falling pound, London continues to be a highly attractive and indeed cheaper prospect for ambitious start-ups, the giants of the tech world and the investment community. The sector of course thrives on immediacy so it's unsurprising US companies don't appear massively fazed by the prospect of a two-year Brexit negotiation period, though that could of course change if a deal isn't done before 2020 as is currently envisaged. And some of the tech giants are signaling their faith in the UK tech economy by upscaling their presence - for example Google and Facebook's investment in premises and people in London in the last couple of months.

While a notable number of firms in advance of the Brexit vote indicated their willingness to relocate from the UK or indeed bypass it altogether, the fact remains that London is still the place to be for tech as one of only a handful of truly global cities. While much has been made of the likes of Frankfurt or Berlin taking up the tech mantle in the event of a hard Brexit, as things stand these locations simply aren't geared up to compete with London's offer - and won't be for many years to come.

This shows in current day to day activity. Anecdotally, we are seeing a number of US tech clients who already have existing London operations actively looking to scale up in the near future. This positivity is also reflected in M&A activity across the space, which has remained buoyant since the Brexit vote, with US companies continuing to see significant value and opportunities in UK-based tech operations. Little wonder then that the UK's digital tech economy is now growing some 32% faster than the wider UK economy, according to industry body, Tech City UK.

The research further indicates some 43% of US firms envisage needing extra technical support to make Brexit a success. That's a huge opportunity and ultimately one the UK is eminently geared up to grasp with both hands in terms of talent, infrastructure and opportunity. Indeed, further research from Tech City UK indicates the sector will create an extra 46,000 tech jobs in London alone by 2024.

Looking further down the line, far greater uncertainties persist that are of increasing concern. As a truly international sector, technology companies thrive on the availability of a rich and highly mobile talent base so any trend towards restrictions on the free movement of people, both within and outside the UK and EU will be keenly felt. Likewise, concern over greater protectionism in the US itself is also ringing alarm bells, as are prospects for the Trans-Pacific Partnership (TTP) following President Elect Trump's recent pronouncements that he will move to scrap it.

For now though, despite all the ongoing uncertainties around what Brexit might mean in practice, it's very much a case of business as usual for US companies active in London's thriving tech scene.

Alex Brodie and David Brennan, co-chairs of Gowling WLG's Tech Sector.

The following graphs highlight how US businesses with a turnover of $13 million or above are already reacting and preparing for Brexit.

Do you think the delay of up to two years (or possibly longer) for the UK to negotiate an exit from the EU will have a negative impact on your business?

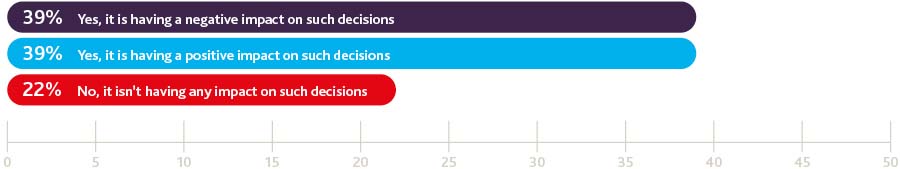

Is uncertainty about the future regulatory environment affecting decisions you are making about trade and investment with the UK right now?

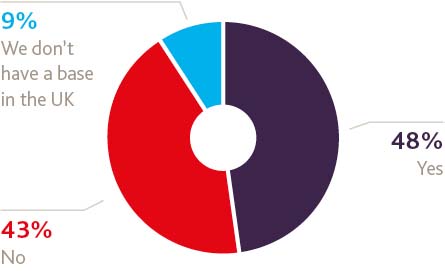

If you have a base in the UK, are you considering moving it to elsewhere in the EU as a result of Brexit?

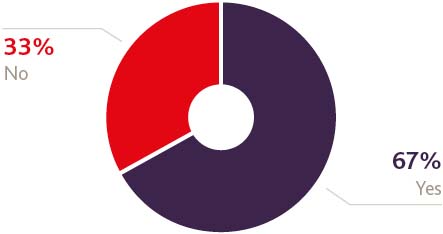

Are you more likely to bypass the UK in order to do business with the rest of the EU as a result of the Brexit vote?

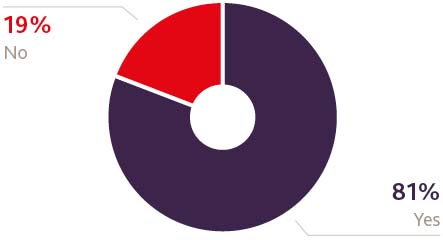

Would you favour a direct trade deal between the US and the UK?

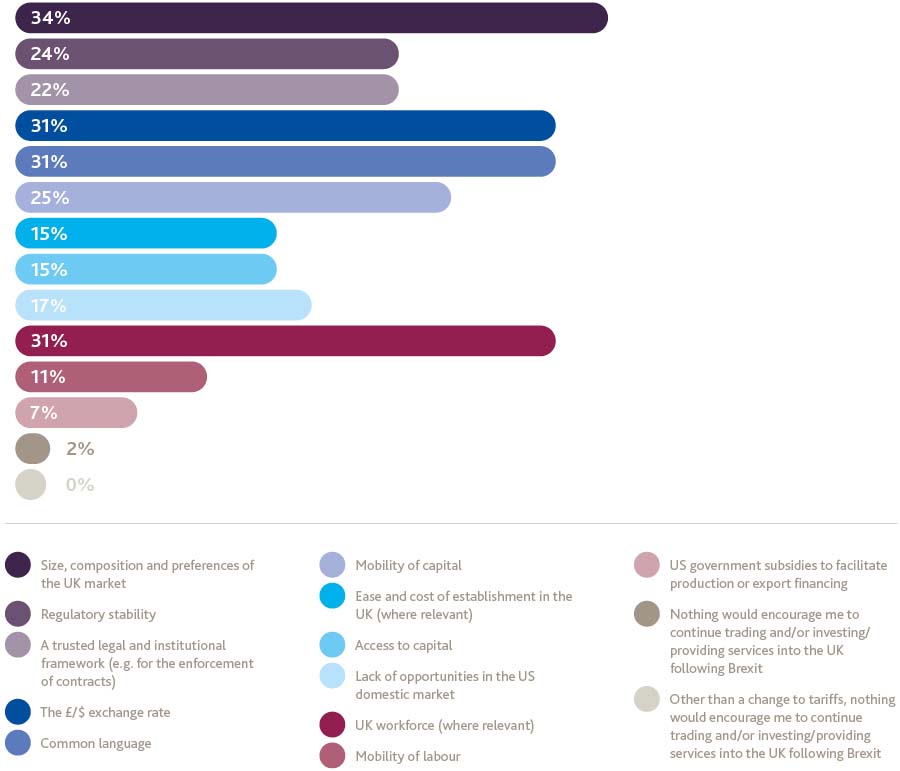

Other than a change to tariffs, what factors would encourage you to continue trading and/or investing/providing services into the UK following Brexit

CECI NE CONSTITUE PAS UN AVIS JURIDIQUE. L'information qui est présentée dans le site Web sous quelque forme que ce soit est fournie à titre informatif uniquement. Elle ne constitue pas un avis juridique et ne devrait pas être interprétée comme tel. Aucun utilisateur ne devrait prendre ou négliger de prendre des décisions en se fiant uniquement à ces renseignements, ni ignorer les conseils juridiques d'un professionnel ou tarder à consulter un professionnel sur la base de ce qu'il a lu dans ce site Web. Les professionnels de Gowling WLG seront heureux de discuter avec l'utilisateur des différentes options possibles concernant certaines questions juridiques précises.