Charles Bond

Partner

Head of Capital Markets

Leader of Natural Resources Sector (UK)

Article

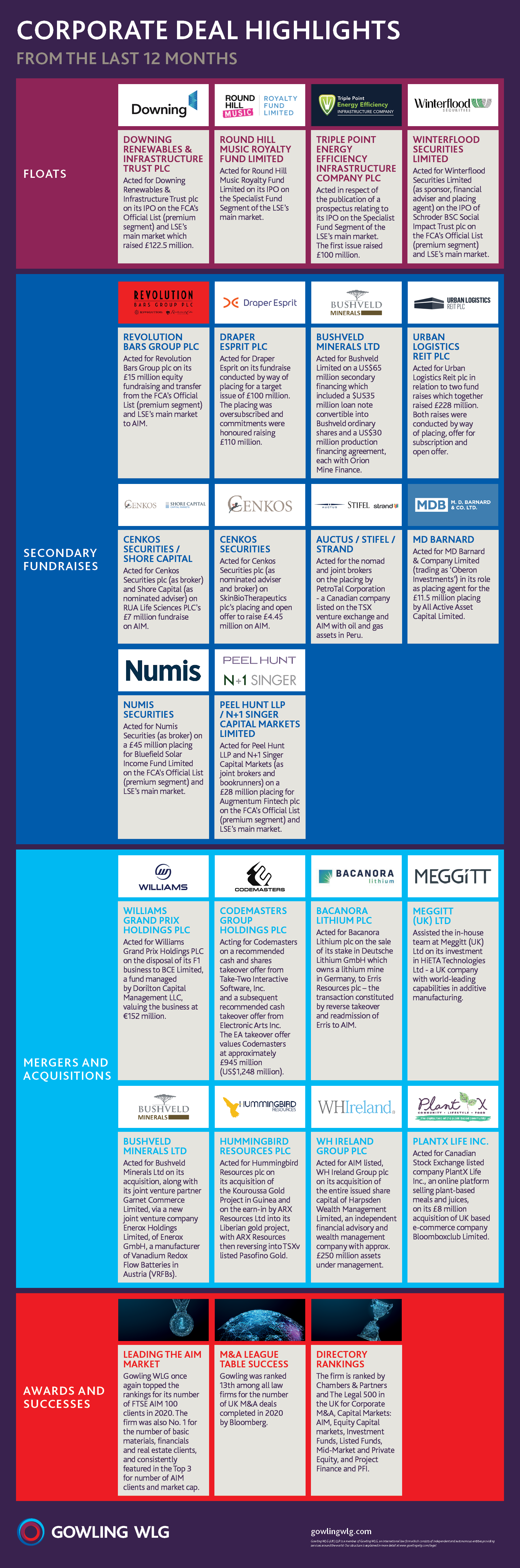

Gowling WLG's Capital Markets and Funds teams have enjoyed a strong start to 2021 following a busy 2020. Over the last 12 months, we've been supporting our valued clients on a variety of corporate matters to ensure their continued success.

Below are just a few of our highlights from 2020, covering floats, secondary fundraises and mergers and acquisitions for leading UK and international businesses, spanning a range of market sectors and services.

Keen to find out how Gowling WLG can support your continued success in 2021? Speak with a member of the team for more on our corporate activity and to understand how our leading lawyers can bring clarity to complex and challenging matters, and solutions to your business needs.

We look forward to working with you in the year ahead.

CECI NE CONSTITUE PAS UN AVIS JURIDIQUE. L'information qui est présentée dans le site Web sous quelque forme que ce soit est fournie à titre informatif uniquement. Elle ne constitue pas un avis juridique et ne devrait pas être interprétée comme tel. Aucun utilisateur ne devrait prendre ou négliger de prendre des décisions en se fiant uniquement à ces renseignements, ni ignorer les conseils juridiques d'un professionnel ou tarder à consulter un professionnel sur la base de ce qu'il a lu dans ce site Web. Les professionnels de Gowling WLG seront heureux de discuter avec l'utilisateur des différentes options possibles concernant certaines questions juridiques précises.