Ben Stansfield

Partner

Article

ESG: The Investor Perspective

15

Environmental social and corporate governance issues (ESG) have moved from the sidelines to the mainstream of the investment industry. In recent years, seemingly disparate elements of ESG policy have come together to create a revolution within the investment management industry.

Gowling WLG has worked with Alex Popplewell, formerly of BlackRock, and Scott Evans of London Business School to create a practical three-part guide – ESG: The investor perspective – to explore what investors are looking for from corporates in their ESG reporting. In this introductory article to the guide, we examine the key reasons why your ESG credentials matter more now to investors than ever before. We delve into how ESG factors have, over time, become a driving force for investor activity, and what this means for your business now and in the future.

In the past 20 years a revolution has taken place in society that has had a profound impact on corporate behaviour, including the world of investment.

A widespread recognition has arisen that ESG issues matter for many reasons, including the potential to drive business growth in new and innovative ways.

As individuals have become more aware of these issues, so they have taken a closer interest in where their pension fund or mutual fund savings are being invested. There has also been a dramatic shift among employees to better understand what their employers are doing in relation to ESG.

At the same time, consumers are now expressing far greater interest in more sustainable products and businesses. This is driving momentum for companies, and their providers of capital (shareholders, banks, bond investors) and, to an increasing extent, their suppliers, landlords, and customers, to adapt to a rapidly evolving environment.

In this context, ESG has grown to become a mainstream component of investment management and has been accompanied by an array of standards, new regulations, and a new audience for corporate communications.

ESG investing is now a substantial part of the investment universe, across equities, fixed income, and real estate, within both public and private markets.

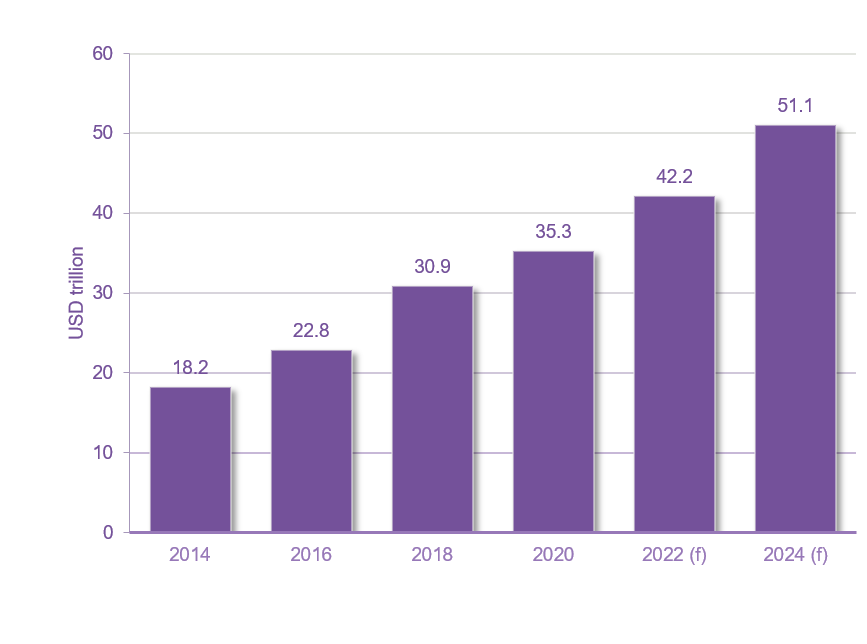

Figure 1: Global AUM in ESG investments ($ trillion)

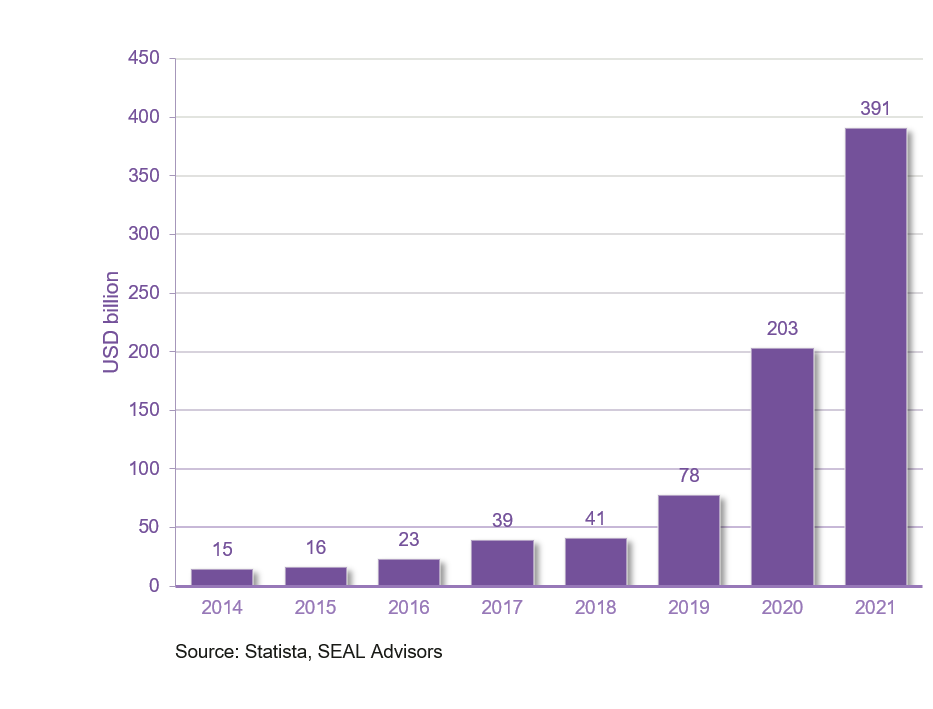

Figure 2: Global ESG ETF assets ($ billion)

In short, ESG is a highly significant and rapidly expanding part of investment management that businesses, whether public or private, cannot ignore.

One section of society that has become vociferous on many aspects of ESG and company ethics is Gen Z[2] – the views of whom are explored closely in Gowling WLG's Tomorrow's World report to help inform companies' future ESG strategies. By harnessing the power of social media and online campaigns, Gen Z has shown itself as adept in addressing companies who it considers to be falling short of their ESG obligations.

In focusing mainly on environmental and social issues, Gen Z has the ability to quickly raise awareness of unethical behaviour by companies; in particular, with regard to employment policies and supply chains. Gen Z is very aware of its rights as employees, and as consumers, and knows how effective the court of public opinion can be in addressing ESG shortcomings.

Gen Z has mastered the art of combining both digital and physical activism to hold businesses to account on ESG issues. They are aware of the power they have as citizens, investors, employees, consumers and activists, both in the real world and on social media. And they have more tools at their disposal to voice displeasure than previous generations. Our research showed that 57% of Gen Z have taken action at least once, with over half boycotting products.

- Tomorrow's World, a Gowling WLG report discussing how Gen Z is driving organisational change

While Gen Z does not always have a direct influence as investors or shareholders, it does have an indirect influence on investor's decisions in that very few asset managers want to be associated with companies that have been exposed for, or even perceived to be engaging in, unethical practices.

It is also the case that many of Gen Z will become the investors of tomorrow. Also, as the group that has fully embraced the core principles of ESG and is very aware of individual and consumer rights and how to force change, it is very unlikely that the influence of the ESG agenda will fade anytime soon.

Many issues that became identified as possible non-financial issues creating financial risk have now been enshrined in legislation. In the UK, successive governments since 2010 have moved to embrace a greener agenda, culminating in the UK's Net Zero emissions by 2050 target. In January 2023, the UK's Environmental Improvement Plan was also published, setting out 10 stretching goals to stop the decline of nature and biodiversity and making way for a host of climate related laws in the coming years.

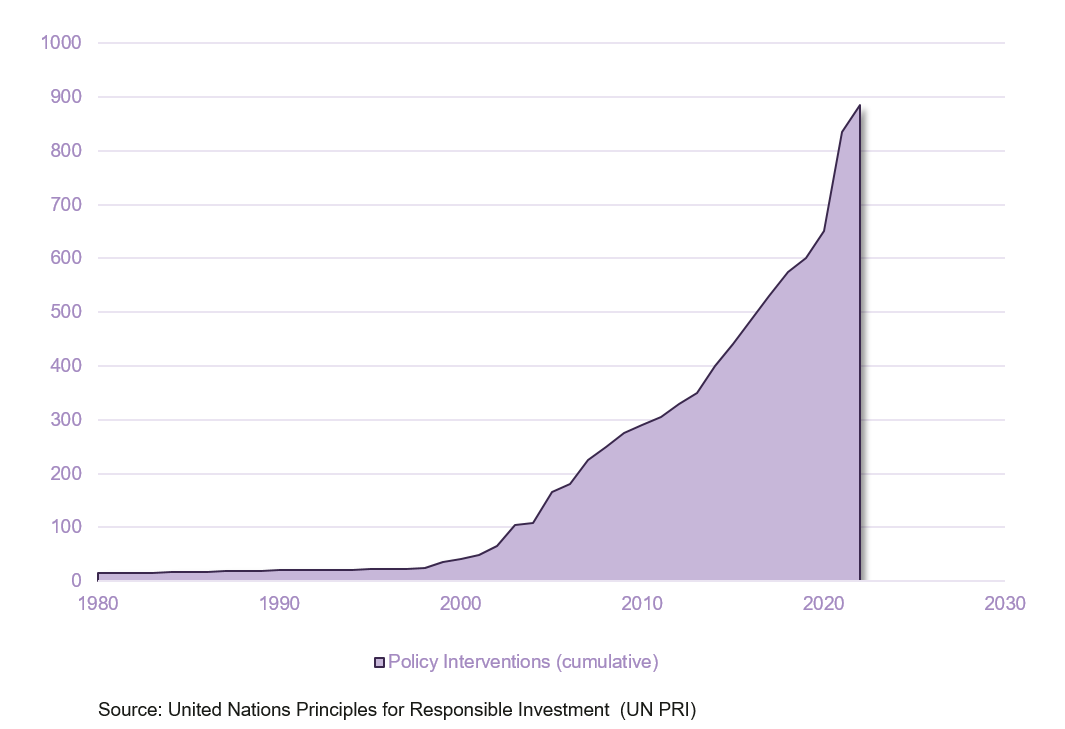

The extent of the rapid expansion in policy interventions relating to sustainable investment can be seen below, which shows that the vast majority of policies have been launched within the last 10 years.

Figure 3: Cumulative number of policy interventions in sustainable investment

While individual investors can move quickly with social trends to change investment strategies, the slower but weightier advance of the large pension funds - often from the public sector in the UK or North America - has driven the new focus on E, S and G.

State funds have reflected wider voter views, as well as those of narrow beneficiaries. The large state pension funds of California and New York led the way by imposing ESG policies on to the management of their investee companies. Self-policing and collaboration led to initiatives such as the United Nations Principles for Responsible Investment (UN PRI), which can act as a clearing house for channelling investors' concerns back to companies.

This became much more accepted after 2005, when the whole concept of fiduciary responsibility was, after a research project by the UN PRI, updated to include a requirement to at least consider ESG risks alongside purely financial risks in their investment process. Every subsequent high-profile incident of corporate malfeasance has seemingly increased the regulations around governance.

Following this updated approach to fiduciary responsibility, fund managers gradually began to see the potential benefits for actively incorporating ESG factors into their investment process. This meant that rather than simply excluding companies that scored poorly in relation to ESG matters they looked to invest in companies with good ESG attributes.

In addition, funds with green credentials began to be able to charge more, or at least resist pricing pressure from index funds, which helped fund managers to see the (green) light.

Whether the incorporation of ESG factors in an investment portfolio adds or reduces value is a widely debated issue in both the academic and professional investment community. A substantial amount of research has been carried out into whether there is conclusive evidence to show a link between a company's ESG policies and financial performance.

In 2021, New York University's Stern Business School published the results of a very large-scale study that looked at over 1,000 academic studies on ESG and financial performance, published between 2015 and 2020.

The main conclusions of this piece of research were:

Point 3 above raises the question of why investors (or companies for that matter) should worry about ESG. If fully complying with ESG obligations does not lead to enhanced investment returns – why has it incited such wholesale change across the investment sector? Professor Alex Edmans, a specialist on ESG analysis at London Business School, answers this question decisively in his 2023 paper looking at the rise in importance of ESG.

"The biggest driver of this ascent [from niche to mainstream] is the recognition that ESG factors are critical to a company's long-term (financial) value … Considering long-term factors when valuing a company isn't ESG investing, it's investing. Indeed, there's not really such a thing as ESG investing, only ESG."

Professor Alex Edmans of London Business School.

What Professor Edmans is advocating is that attempting to quantify a company's financial performance on the basis of some measurable ESG characteristics is not that relevant. This is because ESG is, by definition, a fundamental driver of long-term value creation.

ESG is now an integral part of the investment industry. Any company, public or private, large, or small, needs to understand their ESG obligations – not least to ensure they comply with or anticipate developing regulations to mitigate risk and potential liabilities. Going beyond fundamentals, every organisation is on a journey to improve its ESG strategies and get it right for tomorrow's world. Doing it well and developing your business sustainably means understanding the key influences and what areas matter most to investors.

The growth in consumer and institutional money following ESG strategies is only going to continue, and this is a critical consideration for all companies in the way they engage with investors.

To help shape your approach, our three-part guide – ESG: The investor perspective – provides an informed investor perspective on the key elements of ESG essential for helping companies to deliver improved performance in a changing world, while lowering risk and enhancing reputations.

Our ESG guide provides an informed investor perspective on the key elements of ESG essential for helping companies to deliver improved performance in a changing world, while lowering risk and enhancing reputations. It also gives you insight into the trends to watch out for and offers a practical 10-point sustainability plan to help you work towards long-term sustainable success.

Download 'ESG: The investor perspective'

Footnotes

[1] Refers to assets that are managed by institutional fund managers who incorporate ESG factors into their investment analysis.

[2] Generation Z (aka Gen Z, iGen, or centennials), refers to the generation that was born between 1997-2012, following millennials. This generation has been raised on the internet and social media, with some of the oldest finishing college by 2020 and entering the workforce. Source: Insider Intelligence.

CECI NE CONSTITUE PAS UN AVIS JURIDIQUE. L'information qui est présentée dans le site Web sous quelque forme que ce soit est fournie à titre informatif uniquement. Elle ne constitue pas un avis juridique et ne devrait pas être interprétée comme tel. Aucun utilisateur ne devrait prendre ou négliger de prendre des décisions en se fiant uniquement à ces renseignements, ni ignorer les conseils juridiques d'un professionnel ou tarder à consulter un professionnel sur la base de ce qu'il a lu dans ce site Web. Les professionnels de Gowling WLG seront heureux de discuter avec l'utilisateur des différentes options possibles concernant certaines questions juridiques précises.