Bernardine Adkins

Of Counsel

Article

23

Brexit will cause a fundamental change in the way the UK trades with the EU. The guide is intended to provide practical advice to assist businesses to start to prepare for this change.

At the time of writing, the three most likely Brexit outcomes are:

A mooted and credible further alternative would be 'parking' the UK in the European Economic Area (EEA) for a number of years while a longer term bespoke arrangement is put in place.

This guide is drafted on the basis that the UK will be leaving the EU Customs Union, in line with the UK Government's current negotiating positon. Currently this will take place as of 1 April 2019 in the event of a 'no deal' and as of 1 January 2021 in the event of a negotiated withdrawal by the UK.

Leaving the EU Customs Union will mean that businesses trading goods between the UK and EU will need to file import and / or export declarations. The guide is intended to provide practical advice to assist businesses to start to prepare for this change.

This guide includes:

Our guide is intended as a starting point to assist businesses to identify risks, it should not be construed as exhaustive or definitive.

There is no requirement to complete and file a customs declaration for goods that move around the EU Customs Union that either originate in the EU (or one of the non EU territories that also are member of the EU Customs Union) or have already been imported into the EU Customs Union, duties paid and all customs formalities have been complied with. These goods are referred to as being in "free circulation".

In the event that the UK leaves the EU Customs Union, this will create a customs border. Goods moving across the border will be subject to a customs control process and the person who is responsible for the movement of the goods (the owner of the goods or party having right of disposal over the goods) will be required to file an export and / or import declaration or other similar administrative document which has not yet been defined. Duties and import VAT may also be payable.

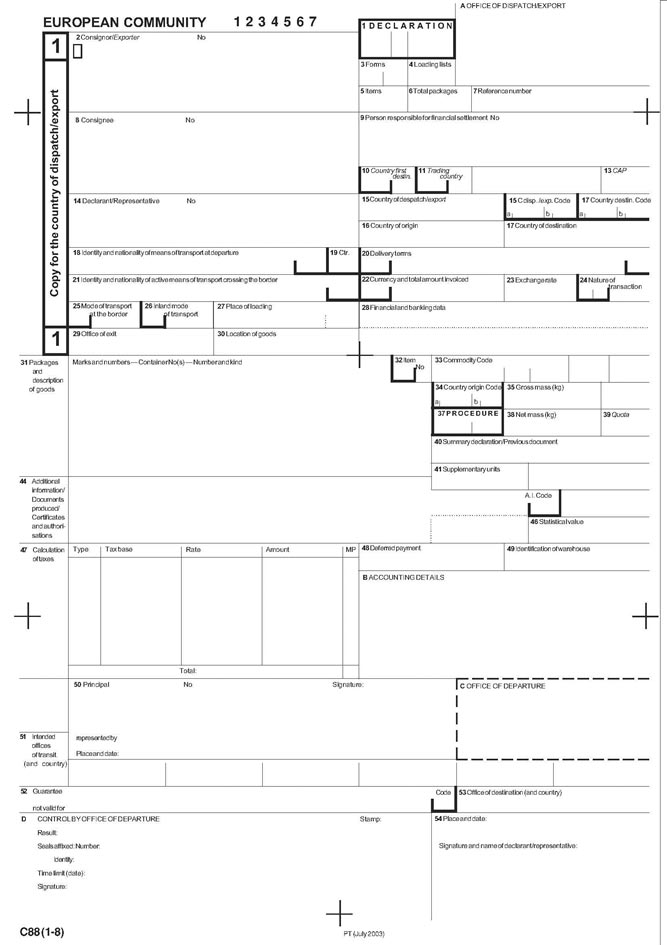

Currently the import or export declaration is commonly referred to in the EU as the Single Administrative Document "SAD" or Form C88 (UK specific).

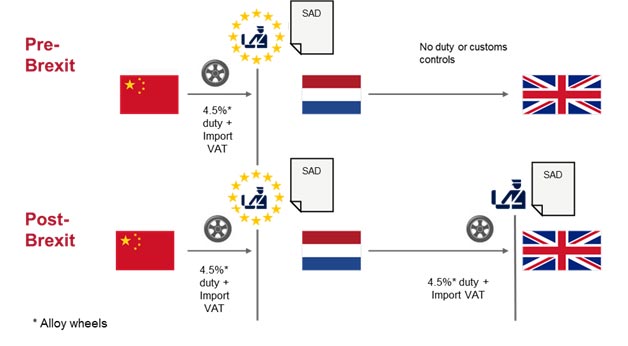

Please find below an illustrative example of the impact of a customs border.

Below is an example Single Administrative Document or C88 (note that the same document is used for both import and export).

We have summarised the key boxes that require completion for an import entry. The guidance is based on a straightforward sale transaction whereby you will need to import the goods into the UK and you appoint a customs agent or freight forwarder to complete the customs formalities on your behalf. We have highlighted those boxes where you will be required to provide accurate information to your customs agent or freight forwarder in order for them to complete the declaration correctly.

The information required for completing this form for import or export may vary depending on the terms of sale, whether a special customs procedure is to be applied and other variables connected to the movement of the goods.

It is important to note that, in the case of an import entry, it is the consignee that has responsibility for the accuracy of the information and data provided to the customs authorities (HMRC) unless otherwise provided for in an arrangement whereby indirect representation is applied.

In the case of an error or misrepresentation then additional duties, import VAT and potentially penalties will become payable by you, the importer.

| Box | Description | Explanation (for import procedure) |

|---|---|---|

| 2 | Consignor / Exporter | Details (name and address) of the person from whom you are buying the goods. This must be the person who sells the goods prior to the import, not the party that is simply responsible for the dispatch. |

| 8 | Consignee / Importer | Details of the person responsible for paying the customs duties and typically the recipient of the goods. If you are the party purchasing the goods from the exporter this will mean that you are the importer in most cases. In order to be an importer you will need to have an Economic Operator Registration and Identification "EORI" number. You can apply to HMRC for an EORI number and it will be linked to your VAT number. |

| 14 | Declarant / Representative | Details of your nominated customs agent / freight forwarder who completes and files the customs declaration on your behalf. In most cases your customs agent / freight forwarder will act as your direct representative for the purposes of completing the customs declaration. This means that they act your name and on your behalf. Therefore you (the importer) remain liable for the customs debt and the correctness of the information entered onto the customs declaration. |

| 16 /34 | Country of Origin | The country of origin (rather than country of dispatch) will determine whether the imported goods may be eligible preferential customs treatment i.e. a lower or zero rate of duty can be applied. Preferential customs treatment will apply when goods are imported from a country with which the EU / UK has concluded a Free Trade Agreement (FTA) and it can be demonstrated that the goods meet the relevant rule of origin which is determined by commodity code (see below). |

| 31 | Packages and Description of goods | The description of the goods must be the normal trade description and detailed enough for immediate, precise identification and classification. |

| 33 | Commodity code | The commodity code is 10 digits in length and is used to identify the nature / materials of the goods. Each commodity code has its own rate of duty. To find the commodity code for your goods, use the government's trade tariff website. There is a complex set of rules for determining which is the correct code to apply and it is important to refer to the Section and Chapter notes to check for specific exclusions, descriptions etc. |

| 37 | Procedure | The customs procedure code (CPC) is a 4 to 7 digit code, which is used to identify what particular type of customs entry for the goods is being filed. Some examples include:

A full list of the current available CPCs is available online. |

| 47 | Calculation of taxes | The calculation of the amount of duty and Import VAT due is based the data in Box 47. The fields will largely be populated on the basis of information entered elsewhere on the declaration. There are five columns:

The customs value of the goods is usually based on the transaction or invoice value, which is the price paid or payable. However there are a number of exceptions to this rule and you should ensure that the price upon which the value is based is also a demonstrable arms-length transaction i.e. the relationship between the buyer and seller has not influenced the price. |

There are currently a number of customs reliefs available to importers and exporters via the Union Customs Code (UCC). The UCC sets out the customs procedures to be applied to the movement of goods in and out of and within the EU Customs Union.

The UK Government's white paper on the future UK-EU trading relationship (the so-called 'Chequers deal')[1] states that the UK intends to leave the customs union and "maintain a common rulebook with the EU, including the [UCC]".

There are two key reliefs that permit the suspension of duties where goods will not permanently remain in the UK (and currently the EU Customs Union). These are customs warehousing and inward processing relief and are briefly summarised below. Both schemes require that businesses obtain pre-authorisation from HMRC before they can be applied and a financial guarantee. The guarantee can be waived for holders of the Authorised Economic Operator (trusted trader) certification or reduced if certain criteria are met.

A customs warehouse allows business to store goods without the requirement to pay import VAT or duty until the goods leave the warehouse and are released into free circulation. If the goods are to be re-exported then the liability to pay import VAT and duty is extinguished.

There are strict conditions regarding the operation of a customs warehouse and the goods must only undergo very limited handling whilst they are stored there.

Inward processing allows businesses to obtain relief from customs duty and import VAT on imported goods that will be processed, manufactured or repaired before being exported.

Inward processing is frequently used within the automobile sector. The EU estimates that 43% of motor vehicle exports in 2011 made use of the inward processing regime.

Setting up a duty deferment account with HMRC will allow businesses to mitigate uncertainty regarding import VAT and customs duty as it will allow importers to pay charges in arrears.

Whilst the UK is a member of the EU's customs union, goods transported between the UK and EU are not subject to tariffs. As noted earlier, post-Brexit UK-EU trade will broadly take place under one of the following scenarios:

This section looks at the potential UK-EU FTA outcome. In this scenario, the EU will afford UK goods preferential tariff treatment (and vice-versa).

Consequently, UK businesses exporting to the EU will need to demonstrate that their goods are manufactured in the UK in order to qualify for preferential treatment. Complying with these rules will be a key issue for UK businesses that presently sell goods into the EU and supply chains that straddle the two customs territories.

The rules for determining preferential treatment are known as rules of origin. A UK-EU FTA will set out these rules - the EU-Canadian Comprehensive Economic Trade Agreement (CETA), for example, contains a specific 145-page protocol on rules of origin. The EU currently has FTAs with a number of countries, and the rules of origin are different for each FTA.

At the moment it is not clear what rules of origin would apply in an EU-UK FTA. However, given the discussion of the 'Canada model' as a possible outcome, the CETA requirements may be indicative of what could be expected in a UK-EU FTA. CETA requires that goods have been:

CETA also contains additional requirements that businesses must fulfil in order to qualify for preferential treatment. Notably, CETA requires that goods must be transported directly from Canada to the EU and that businesses register for the Registered Exporter system (known as "REx"), unless the export is shipment is valued at under €6,000.

It is likely that a UK-EU FTA would contain similar requirements - in particular with relation to the REx system. Under CETA, registering for REx entails the completion of a three page form. In addition, the exporter must then make a pre-determined origin declaration (the template for which is contained in CETA itself) on a "commercial document", e.g. an invoice.

To ensure you are prepared to export to the EU after Brexit under a FTA, you should:

If the UK leaves the EU without any kind of trade deal it will conduct trade with the EU on the basis of what are referred to as WTO rules.

The 'WTO rules' is an umbrella term for the WTO Agreement. The WTO Agreement comprises several agreements, notably:

These agreements govern the international rules for trade in goods, services and of intellectual property. There are some 164 countries who are members of the WTO.

In addition, the WTO Agreement contains,

The Most-Favoured-Nation (MFN) Treatment principle requires that WTO members do not discriminate against fellow WTO members. All WTO members must afford MFN treatment to one another.

There are exceptions are to the MFN principle. Between the UK and EU, the following apply:

The National Treatment principle provides that once foreign goods have been imported into the national market, they should be given the same treatment as domestic goods. This principle also applies to foreign and domestic services as well as to trade-marks, copyrights and patents.

The national treatment principle only applies once a product, service or item of intellectual property has entered the domestic market. Customs duty on imports does not violate this principle.

The current version of GATT was agreed by the WTO in 1994. The GATT encompasses matters such as import licensing, subsidies, anti-dumping and rules of origin in relation to trading goods.

Quantities of goods inside a quota are charged lower import duty rates than those outside of the tariff quota. WTO members set out their tariff quotas, if any, in their respective schedule of commitments annexed to the GATT.

Tariff rates on goods specified by WTO members under the WTO rules are known as 'bound tariffs' or 'bindings'. The tariffs refer to the maximum rate of customs duty that a WTO member can charge on imported goods.

However, a WTO member is free to apply lower tariffs than the bound rates (provided the MFN basis is adhered to).

Each EU Member State is a member of the WTO and the EU Commission represents the EU Member States on most WTO matters. Although the UK is a member in its own right, it has no independent tariff schedules, these being negotiated and agreed by the EU on behalf of all the EU Member States.

The UK will remain a member of the WTO following its withdrawal from the EU. A letter dated 11 October 2017 from the UK and the EU to WTO members confirms that the UK will have its own separate schedules of commitments for goods (this includes tariffs imposed) and services, to take effect immediately upon leaving the EU. The letter also states that "the UK intends to replicate as far as possible its obligations under the current commitments of the EU." The letter therefore confirms the UK government's intention to mostly mirror the current WTO tariffs imposed by the EU.

In a no-deal scenario the WTO rules will govern the UK's trade with the EU and other WTO members. However, the UK will need its own separate schedule of commitments as it will no longer be able to rely on the EU's tariffs. The UK's proposed schedule of commitments is currently with the WTO members for review (this document is not publically available at this time). Quotas, however, will be a different issue and the UK is likely to have to negotiate a fresh set of quotas with other WTO members.

Footnote

[1] Available at: The future relationship between the United Kingdom and the European Union (see page 18).

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Gowling WLG professionals will be pleased to discuss resolutions to specific legal concerns you may have.