Paul Carenza

Partner

Article

On July 27, 2020, Royal Assent was given to Bill C-20, An Act respecting further COVID-19 measures, which amends the Canada Emergency Wage Subsidy ("CEWS"). Bill C-20 extends the duration of the CEWS to December 19, 2020, broadens the scope of the CEWS to apply to more employers and introduces a declining subsidy rate to reflect the anticipated recovery in employers' revenues during the 2nd half of 2020. For most employers, other than those in the industries most severely impacted by the COVID-19 related closures, the amended CEWS will provide a more modest wage subsidy as compared to the 75% subsidy that has been in effect since March 15, 2020. Details regarding the preview structure of the CEWS can be found here.

Bill C-20 implements the following key changes:

As with the prior iteration of the CEWS, the subsidy will be available to a qualifying entity for a qualifying period in respect of eligible remuneration paid to an eligible employee. For the most part, these concepts have not changed.

To date, there have been four qualifying periods, covering the period from March 15, 2020 to July 4, 2020. Bill C-20 provides for 5 additional qualifying periods covering the time period from July 5, 2020 to December 19, 2020 (although parameters for the final period have yet to be released).

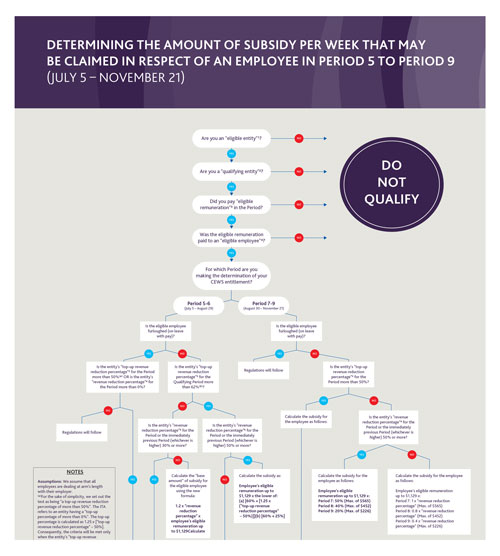

For the first four qualifying periods, the per-employee subsidy was set at 75% of eligible remuneration, up to a maximum of $847 per week, for qualifying entities that suffered at least a 30% revenue reduction. As of the qualifying period that commences on July 5th, 2020, there is no longer a requirement that the eligible entity suffered at least a 30% reduction in revenues. Instead, a two-part subsidy is available, depending on the revenue reduction experienced by the eligible entity. As the rates applicable to the various qualifying periods decrease over time, the rules are fairly complex. Below is a brief summary of the new rules. The attached flowchart serves as a decision tree and provides greater detail.

The base subsidy is the employer's base percentage, which in turn is based on the employer's revenue reduction percentage.

For an employer that has experienced a revenue reduction percentage of 50% or more in the relevant qualifying period, the base percentage is 60%, with the rate falling to 50% for the qualifying period commencing on August 30th, 2020, then to 40% for the qualifying period commencing September 27th, 2020, then to 20% for the qualifying period commencing October 25th, 2020.

For an employer that has not experienced a revenue reduction percentage of 50% or more in the relevant qualifying period, the base percentage is the employer's revenue reduction percentage multiplied by a multiplier that starts at 1.2 (for the qualifying period that commenced on July 5th, 2020), falling to 1.0 as of August 30th, to 0.8 as of September 27th, 2020, and to 0.4 as of October 25th, 2020.

For example, an employer that has experienced a revenue reduction of 40% for the qualifying period of July 5-August 1, and has paid each employee $1,000 per week during the qualifying period, the revenue reduction percentage would be 40%, the base subsidy would be 40% x 1.2 or 48%, and the subsidy would be $1,000 x 48% or $480. As the multiplier is reduced as of August 30th, even if the employer continues to experience the same revenue reduction percentage, the subsidy amount would decrease.

The top-up subsidy will be available to employers that have experienced at least a 50% reduction in revenue. More specifically, the top-up subsidy is the employer's top-up percentage, which is the lesser of (a) 25% or (b) the employer's top-up revenue reduction percentage minus 50% x 1.25. The top-up revenue reduction percentage is determined by comparing the average monthly qualifying revenue for the last 3 completed calendar months prior to the relevant reference period, divided by the average of the employer's qualifying revenue for the prior reference period, which is either January and February 2020 or the last three completed calendar months prior to the prior reference period.

To ease the transition from the previous 75% subsidy regime to the two-part subsidy, there is a "safe harbour" rule that applies for the two qualifying periods running from July 5th, 2020 to August 29th, 2020. For those periods, an employer that has experienced a revenue decline of at least 30% will be entitled to a subsidy equal to the greater amount under either the 75% regime or the two-part regime.

The attached flowchart is designed to assist employers in determining eligibility and applicable CEWS rates for each of the qualifying periods as of July 5th, 2020 and includes relevant definitions and charts.

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Gowling WLG professionals will be pleased to discuss resolutions to specific legal concerns you may have.