Clément Stacey

Associate

Article

In the 2023 Fall Economic Statement, the Government of Canada announced the Canadian Mortgage Charter ("Charter"), which requires federally regulated financial institutions ("FRFIs") to follow certain principles when engaging in mortgage lending. The federal government's Budget 2024, further enhances the Charter and gears it towards aiding renters and assisting young people.[1]

It is estimated that, in 2024 and 2025, 2.2 million Canadian households, representing over $675 billion worth of Canadian mortgages held by the country's chartered banks will come up for mortgage renewal.[2] On April 10, 2024, the Bank of Canada announced it will be holding its key interest rate at five per cent for the sixth time in a row since July. As the future of mortgage rates remain uncertain, lenders must be prepared to make available a variety of mortgage relief options to help borrowers potentially facing an interest rate shock.

In anticipation of increasing interest rates, the Charter "details the tailored mortgage relief that the government expects lenders to provide Canadians facing a challenging financial situation with the mortgage on their principal residence."[3]

For the most part, the Charter restates existing guidance set out by the Financial Consumer Agency of Canada ("FCAC") in its Guideline on Existing Consumer Mortgage Loans in Exceptional Circumstances, albeit in a more high-profile document. Note that the federal government does not intend to publish the Charter as a standalone document; it will remain as set out in the 2023 Fall Economic Statement.

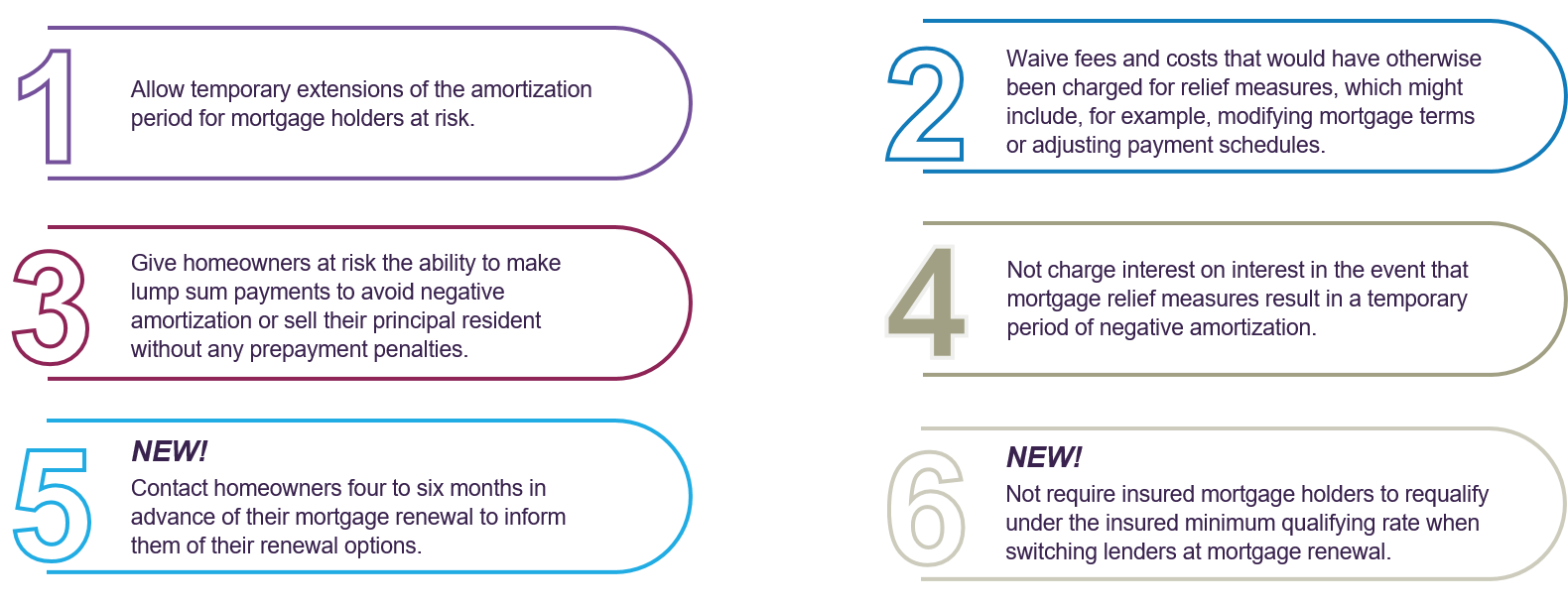

The six relief measures in the Charter pre-Budget 2024, of which two are not contained in the FCAC guidance, require lenders to:

One of the Charter's few novelties is also the most controversial.

The federal government introduced the mortgage stress test for certain borrowers in 2016. The Office of the Superintendent of Financial Institutions ("OSFI") introduced guidance for FRFIs engaged in mortgage lending that effectively expanded the mortgage stress test to more borrowers. The mortgage stress test gives lenders the ability to evaluate whether a borrower will be able to afford their mortgage payments when interest rates rise. It is generally applied when purchasing a home, refinancing, renewing a mortgage, taking out a second mortgage or applying for a home equity line of credit.

The Charter lifts the stress test requirement for insured mortgages when switching banks upon renewal. Whereas this measure gives borrowers more flexibility to "shop around" for better rates, mortgage lenders carry an additional risk – they now have to trust that the originating bank qualified the borrower adequately. Note that the stress test may still be applied for uninsured mortgages.

The Charter set the standard of how the government expects Canada's FRFIs to carry on business with vulnerable borrowers. Both the FCAC and OSFI are expected to closely monitor the mortgage relief offered by financial institutions.

If a lender were to contravene the principles set out in the Charter, a borrower may file a complaint by contacting the FCAC, which, in turn, reports the number and types of complaints to Parliament. As a lender, it is important to note that the Canadian federal government closely monitors financial institutions' compliance with the Charter.

The Charter is part of an increasingly complex regulatory environment for mortgage lenders, led by OSFI's focus on the risks to FRFIs associated with real estate secured lending. OSFI listed this topic as a key priority in its Annual Risk Outlook for 2023-2024 and its Semi-Annual Update. This has informed a number of regulatory developments from OSFI on real estate secured lending for FRFIs, which we will continue to monitor.

Our Financial Services Regulation practice group is prepared to address any questions related to the Charter and its effects on mortgage lending in Canada.

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Gowling WLG professionals will be pleased to discuss resolutions to specific legal concerns you may have.