Government of Canada updates tariffs on U.S. imports: What you need to know

These changes aim to provide tariff relief to Canadian businesses by reducing the financial burden caused by surtaxes on a variety of goods and materials.

Read more

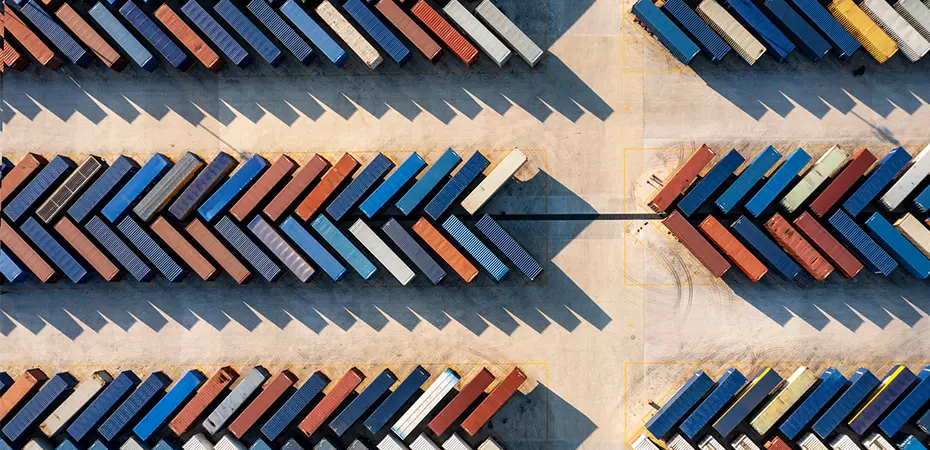

With tariff tensions dragging on and no clear resolution currently in sight, businesses on both sides of the border must continue to identify vulnerabilities and take steps to ensure their continuity plans can withstand prolonged uncertainty.

Not sure where to begin? We recommend focusing on the areas below as a matter of priority.

Sign up to receive our Insights newsletter to receive the latest updates straight to your inbox.

SubscribeIdentify what goods your business trades cross border between the U.S. and Canada. Determine how these goods are classified from a tariff perspective, their value, and their country of origin.

Determine who the importer is and who is contractually liable to pay the tariffs. Review existing contracts to understand if liability-sharing provisions are in place or if they can be negotiated to mitigate financial risks.

Evaluate whether it is feasible to stockpile products before tariffs take effect or explore sourcing goods from other markets or suppliers to avoid or minimize tariff exposure.

Coordinate with industry partners to highlight the economic impact of tariffs to Canadian government officials, explaining why certain products should be excluded from retaliation lists or prioritized for later rounds.

Tariffs on imported goods may be tax-deductible in some cases, making tax planning essential to your tariff-response strategy. Tariffs may also be included in expenses that qualify for other tax credits, such as scientific research and experimental development credits or manufacturing tax credits.

These changes aim to provide tariff relief to Canadian businesses by reducing the financial burden caused by surtaxes on a variety of goods and materials.

Read more

In response to ongoing U.S. tariff measures, Canadian governments are reevaluating their procurement policies. In this article, we explore Ontario’s new Procurement Restriction Policy and similar actions emerging across Canada.

Read more

Canada introduced new relief measures to support businesses hit by U.S. tariffs. Here, we break down what these new measures mean for businesses navigating cross-border trade.

Read more

On April 2, 2025, President Donald Trump announced a sweeping set of tariffs on what he called "Liberation Day," aiming to reshape the international trading system built by the United States after the Second World War.

Read more

As trade tensions rise, what's next in this evolving dispute? This article highlights the key developments, economic implications, and what businesses should watch for moving forward.

Read more

The sudden imposition (and sometimes withdrawal) of tariffs is adding uncertainty to the construction industry. How do industry-standard CCDC contracts handle these risks? Who bears the cost when tariffs change?

Read more

With tariff uncertainty reshaping global trade, protecting intellectual property has never been more important. By identifying key IP assets, securing patents abroad, and taking advantage of international trademark systems, Canadian businesses can better position themselves for long-term success.

Read more

The cost of building in Canada is at risk. With proposed U.S. tariffs on steel, aluminum and other key materials, Canadian construction and infrastructure projects are bracing for higher costs, supply chain delays and increased contract risks. What does this mean for industry players—and how can you prepare?

Read more

While the U.S. tariffs on Canadian goods promise to significantly impact organizations importing goods into the United States, Canada's expected retaliatory response will be no less consequential for organizations exporting goods from the U.S. into Canada.

Read more

How will U.S. tariffs affect your workforce? From compensation changes to potential layoffs, Canadian employers must plan carefully to avoid legal risks. Get ahead of the challenges by understanding the key employment law considerations that must shape your response.

Read more

As trade tensions between Canada and the United States escalate, Canadian businesses importing goods from the U.S. face increased costs due to retaliatory tariffs. This article outlines comprehensive strategies to help businesses assess and mitigate the impact of these tariffs.

Read more

From understanding "Made in Canada" vs. "Product of Canada" to navigating regional claims, national symbols and third-party certifications, here's what you need to know before making a Canadian origin claim.

Read more

This guide identifies the primary risks posed by the proposed tariffs and outlines practical strategies and proactive measures organizations can take to prepare for the potential changes ahead.

Explore our recent guide

As trade tensions evolve, our lawyers remain front and centre in the media, delivering timely, sector-specific insights to help businesses navigate uncertainty.

Tariff troubles? Let's talk